Deutsche Bank: Three charts that show these are extraordinary times

European Central Bank (ECB) president Mario Draghi lit several monetary fireworks last week, and traders are paying attention.

While ECB policy is still the tightest of any central bank in the G10, the steps Draghi took were stronger than investors has expected.

Thursday saw Draghi unveil a package of five key measures: cuts to two key interest rates, and three other policy devices aimed at boosting lending.

In this morning's email to clients Deutsche Bank strategist Jim Reid says that "Draghi has certainly made a huge impact on financial markets" as several European bond markets hit yield lows on Friday, with many hitting fresh multi-century all-time lows.

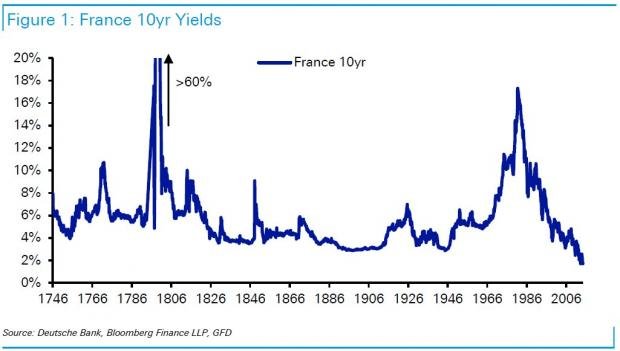

Yields on these bonds imply the cost of borrowing that governments face. French 10-year yields hit 1.654 per cent, an all-time low for data going as far back as 1746. 10-year Spanish yields also hit all-time lows for data that goes back to 1789.

Italian yields have only been lower in yield for a few months in early 1945, with data going back to 1808. This series seems a bit stranger than the rest, if you're aware that "Italy" didn't exist in 1808. Simon Hinrichsen points out that Deutsche Bank has spliced together data for modern Italy, along with Naples and the Two Sicilies bonds for earlier dates.

Reid concludes that "if anyone is in any doubt how extraordinary this period is in economic history then please take a look".