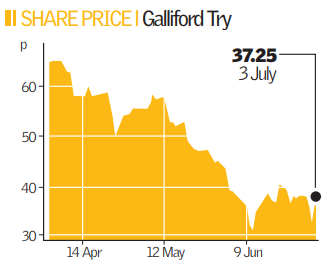

Debts boost for Galliford helps shares

Housebuilder and construction firm Galliford Try surprised the City yesterday, saying it had been able to slash its debt to less than £5m, sending its shares up 14 per cent by the close of trading.

The figure fell well below analyst expectations, with predictions that the firm, which operates in the public and private sector, would post debt of around £100m.

“Next year, we expect significant net cash, allowing (Galliford) to buy land at swingeing discounts from distressed sellers,” Dresdner Kleinwort analyst Alastair Stewart wrote in a research note.

Galliford’s upbeat trading statement was by far the most positive news the market has received from a housebuilder in the last few weeks.

Taylor Wimpey’s future was left hanging in the balance on Wednesday as it failed to secure £500m of funding from investors.

Galliford, for the year ending 30 June 2008, said pre-tax profit would be around £60m and said that total housing completions were 2,524 compared to 2,433 for the same time last year.

But the group yesterday said it expects house prices to fall by between 7 and 15 per cent over the next year.

“You could say our forecast assumes prices will reduce by somewhere between 7 and 15 per cent from where they are now,” chief executive Greg Fitzgerald said.

The company is shedding 256 jobs at its housebuilding division.