CRH hit by sharp fall in house building

Irish building materials firm CRH said yesterday that it expects a “high single percentage” drop in pre-tax profits this year, blaming a downturn in its key markets and a weakening dollar.

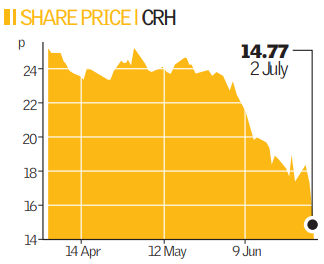

It forecasts pre-tax profits to 30 June of €600m (£478m), compared with €670m in 2007. Following the news, shares in the second largest provider of construction supplies fell 10 per cent in Dublin trading to €15.56. Its stock has declined by 34 per cent this year.

A curb on lending has throttled demand for new homes in the US, where CRH gets more than 40 per cent of its revenues. According to the firm, the number of American new builds dropped by 25 per cent in 2007, the steepest decline since 1980, and could fall by another “double digit” amount in 2008.

CRH also said that dollar weakness had hurt the firm. At current levels, it will have an “adverse translation impact” of over €80m on profit.

“The ongoing negative economic developments and financial market pressures of recent months are having an impact on business sentiment, leading to weaker demand,” CRH said in a statement.

Earlier this week Credit Suisse cut its price target on the stock and warned clients against investing in the European building materials industry. “We continue to see material downside risks in these regions in the coming years, with declining volumes, a weaker pricing environment, rising production costs and margin pressure in many markets,” said Credit Suisse.