Credit Suisse swings back into the black

Swiss bank Credit Suisse has returned to profit in its second quarter, thanks largely to its private banking arm.

The group outstripped analysts’ predictions, recording profits of Sfr 1.2bn (£560m) in the three months to 30 June, reversing losses made in the first quarter.

The figures showed a 62 per cent fall in profits year-on-year, easily beating forecasts, aided by smaller asset write-downs than expected and profits posted by its investment bank, private bank and asset management business.

The group’s investment banking arm made pre-tax profits of Sfr281m in the quarter, down from Sfr2.5bn year-on-year, but net write-downs in the unit were only Sfr22m.

Chief executive Brady Dougan said: “We are pleased with our second quarter results, which reflect the resilience and earnings power of our integrated business model and our continued focus on risk and cost management.”

Wealth management grew more than two times faster than forecast, hitting Sfr15.4bn.

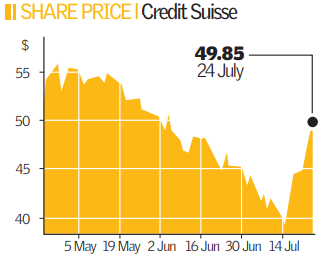

Shares in Credit Suisse rose 5.4 per cent to Sfr 52.60, following a near 40 per cent rise since it touched a 52- week bottom on 16 July.

But the bank remained cautious, warning that volatile market conditions would continue.

Credit Suisse has reported billions of dollars in losses due to the credit crunch and was forced to admit billions more after a trading scandal.

Chief financial officer Renato Fassbind said the credit crunch was “definitely still here”.

However, Credit Suisse has suffered less from its exposure to toxic mortgage debt securities than UBS, its arch-rival, which has written off about £19.1bn.

The bank has not had to turn to shareholders for cash, unlike UBS and other European rivals like Royal Bank of Scotland and Credit Agricole.