Could now be the moment to enter the dragon?

As the Olympics begin, China has never been more intriguing, says Samantha Downes

It was once a region where only the least risk-averse would fear to tread, but China has emerged as a magnet for investors’ cash. In the last decade the communist-run country has emerged as the world’s second largest economy. Its willingness to trade with resource-hungry Western nations has boosted its fortunes.

The Olympic Games, which begin today, will bring the world’s attention to the country as never before. It will give observers a chance to glimpse the new China, and is sure to influence decisions on whether they want to be involved in the country.

On the face of it, China is an attractive prospect. It has avoided the worst of the global credit crunch, and while Western economies groan under its strain, Gigi Chan, manager of the Threadneedle China Opportunities fund, predicts that China’s economy will grow by 10 per cent in 2008. He believes rising incomes combined with the Chinese love of saving will fuel a sustainable rise in consumer spending.

“In this respect China is a mirror image of the developed western economies,” he says. “While the UK and US are grappling with high consumer indebtedness and a sharp slowdown on the high street, Chinese retail sales are growing at around 20 per cent per annum.”

Furthermore, rapid urbanisation also means that China is having to invest in its transportation networks as well as other infrastructure. This all sounds incredibly impressive, but some investment experts say that such high growth brings with it the risk of inflation.

Some China-watchers disagree, though, and believe that China’s protectionist economy gives authorities the option to absorb food and oil price pressures through increased subsidies.

This means that even despite the huge rises in the price of pork – a staple in much of China – the economy will not be adversely affected. Diamond Lee, manager of the £110m Resolution Asset Pacific Growth fund, says that “China’s inflation cycle is simply different to the rest of the world.”

Hi-Tech

It is also modern. Some investors still perceive China to be a provider of low cost goods at minimal cost, but that is not the case. China manufactures 70 per cent of the world’s laptop computers. In 2007, the growth in high value industries, such as the auto industry, grew by over 90 per cent and shipping by 50 per cent in value terms, while the so called old economy sectors such as toys and footwear rose by only 15 to 20 per cent.

In the 10 years to 2007 exports for low-end goods fell by approximately 10 percent while exports of high end goods rose by 25 per cent.

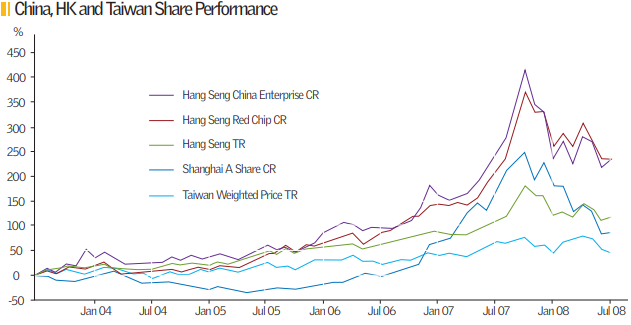

Chinese businesses tend to have low levels of debt and can afford to spend more on growth going forward. However, China is not risk-free. Marcel Porcheron, analyst at London-based investment advisers Bestinvest, says: “There are of course many world class Chinese companies but there are some really shady ones.” He also points out that after huge rises 2007, Chinese stock exchanges have dropped by nearly 30 per cent this year.

Long Term

If you do want to take the plunge, there are many ways for an investor to put their money into China. Some suggest that property is an option, but most agree that the best way to get exposure is through an open ended investment company or investment trust.

Porcheron explains that very few funds invest directly in Chinese companies: “Investing in China is incredibly complicated, and foreign investors are restricted as to how many shares they can buy. Most funds do not invest direct in Chinese companies and instead get their exposure via Hong Kong- or Taiwanese-listed stocks.” The key is to have a fund manager who understands the peculiarities and nuances of the local market.

Among the funds that he recommends are the £167m First State Greater China fund, because it invests directly in A class shares, which tend to only be made available to local investors.

Like all Chinese-themed funds, it should be viewed as long-term bet; although it returned 73 per cent in the three years ending July, it made a 5 per cent loss in the year to 31 July 2008.

Huge Returns

Investors ought to remember that although it is a large economy, China is an emerging one, and has risks attached. Rather than investing in a China only fund, a more diversified Asia Pacific themed fund might be a sensible way to get exposure to China. Aberdeen’s Asia Pacific Fund, for example, returned 41 per cent over the last five years, and First State’s 73 per cent.

Another option is JP Morgan Chinese, which has returned 90.95 per cent in the last year, 153.75 per cent in the last three years, 210.16 per cent in the last five and 281.6 in the last 10 years.

Edinburgh’s Dragon investment trust has returned 98.94 per cent in last year and 147.89 in the last three.

Most investors expect China to continue growing, and to become one of the drivers of the world economy for decades to come.

The Olympics is more than just a side show in this and investors will surely watch closely. John Millar, manager of the Martin Currie Pacific investment trust, says, “As we saw with South Korea in 1988, such an event can have a major impact on the international perceptions of a country.”

All will become clear in the next two weeks. For now, it’s time to crack open a beer and enjoy the synchronised swimming.