Consumer confidence and personal deposits up as business borrowing increases

(BBA)

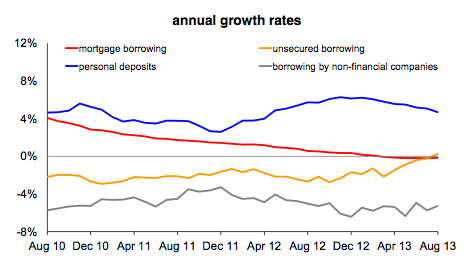

Personal deposits have risen by almost five per cent over the year to August, says the BBA. (Release)

BBA statistics director, David Dooks said:

These figures suggest that consumer confidence is growing. For the first time in four years, annual growth in household borrowing on credit cards and personal loans has turned positive and mortgages approved for house purchase are also at their highest level since 2009.

The BBA reported that borrowing levels by small and medium-sized companies was stable in August which, Dooks said, was influence by large corporates making use of alternative market funding.

IHS Global Insight's Howard Archer says:

Stable lending to small and medium-sized companies in August fuels hopes that banks are now becoming more prepared to lend to businesses and that the Funding for Lending Scheme (FLS) may be starting to have more of a positive impact, perhaps helped by the extension to the scheme in April.

The Bank of England has partly attributed weak bank lending to businesses to several major lenders still being in the process of restructuring their balance sheets and running down some of their non-core assets. In particular, several lenders are reducing their exposure to the commercial real estate sector.

Stable lending may also be a sign that companies are starting to step up their borrowing as markedly improved economic activity in recent months lifts their confidence and need for capital.

There was clearly been low demand for credit in the early months of this year, with many companies still very wary about borrowing and investing in a prolonged difficult economic environment. In addition, a number of larger companies are looking to alternative sources to raise capital. Furthermore, many companies are looking to pay down debt.

As demand for credit does pick up, it is vitally important for UK growth prospects that all companies who are in decent shape and who do want to borrow – whether it be to support their operations, lift investment, explore new markets – can do so, and at a non-punishing interest rate. This applies to all companies, whatever their size.

August saw:

- Personal deposits rise by almost five per cent in the year to August

- New spending of £8.4bn on credit cards – higher than recent monthly averages

- Net borrowing of £175 million on credit cards

- Net repayment of £99 million on personal loans and overdrafts

The BBA also reported that unsecured consumer credit went up by £76 million in August – the fourth modest increase in five months.

(BBA)

Howard Archer comments:

It is likely that markedly improving consumer confidence means that people have become more prepared to borrow in recent months. It may also be that the squeeze on consumer spending coming from inflation running well above earnings growth means that some people are having to borrow more to finance any major spending.

Also significantly, lenders are making more unsecured credit available to consumers. Specifically, the July quarterly credit conditions survey from the Bank of England revealed that lenders reported that there was an increase in the amount of unsecured credit made available to consumers in the second quarter and that a “significant” further increase was expected in the third quarter. This suggests that the Funding for Lending Scheme is having some positive impact in lifting the amount of unsecured credit available to consumers.

Nevertheless, unsecured consumer credit remains low compared to the levels seen before the 2008/9 crisis, and the overall impression is that consumer appetite for taking on new borrowing is still relatively limited while many consumers remain keen to reduce their debt.