Inflation to peak at more than 18 per cent, reckon Citi forecasters

Inflation is set to surge above levels seen during the oil price shock in the late 1970s in a sign the UK economy is hurtling toward a long slump, new forecasts published today show.

The cost of living will climb to 18.6 per cent in January, pushed higher by the energy watchdog hiking the cap on bills even further to pass on steep wholesale gas costs, according to Wall Street investment bank Citi.

That would be the highest rate in around half a century and above the just under 18 per cent inflation peak during the oil crisis five decades ago, caused by Opec cutting supplies.

Interest rates may have to climb “well into restrictive territory, and quickly” to prevent inflation taking hold of the UK over the long-run, Benjamin Nabarro, chief UK economist at Citi, said.

He added the Bank of England could be forced to send borrowing costs to six or seven per cent, a level they have not been since the turn of the millennium.

There are signs inflation has peaked in countries comparable to the UK. The US’s rate dropped much quicker than expected last month to 8.6 per cent. Britain already has the highest inflation in the G7.

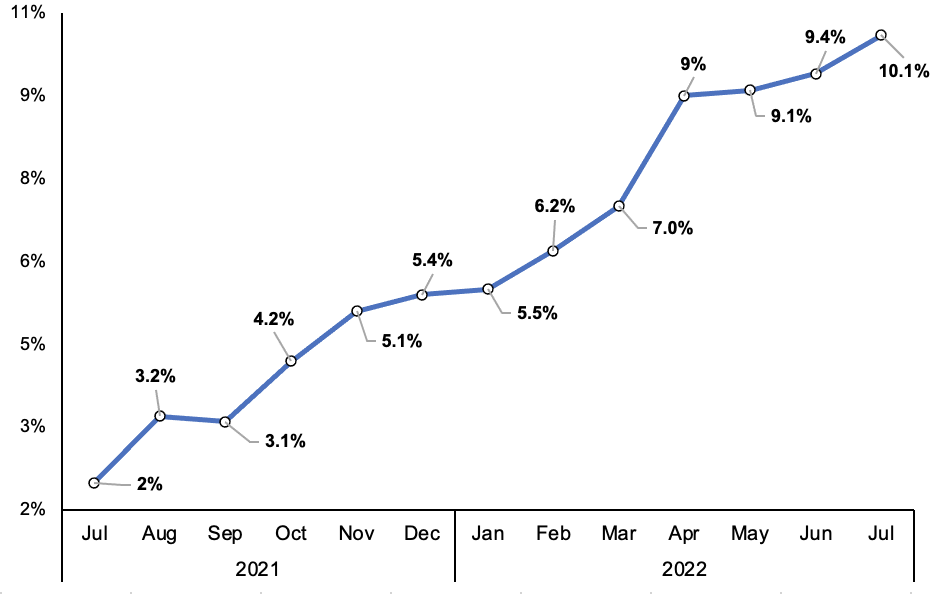

Annual CPI UK inflation

Analysts at Citi said household finances are set to come under intense pressure from the price surge, forcing them to slash spending, tipping the UK economy into recession.

Elevated energy prices, caused by Russia’s invasion of Ukraine disrupting the European gas market and global supply being outpaced by a sudden burst in demand after the Covid-19 unlocking, have sent inflation on an upward spiral.

Ofgem, the market regulator, is on Friday expected to announce bills will climb around 75 per cent in October. Citi said bills may jump above £4,500 in January based on current gas future prices.

Citi’s warning underscores the scale of the challenge awaiting either Liz Truss or Rishi Sunak when one of them enters Number 10 on 5 September.

Truss has pledged to cut taxes to ease the cost of living, while Sunak has hinted at stepping up cash payments to the most vulnerable households.

The new forecasts are gloomier than the Bank’s projection earlier this month, which were branded by fellow investment bank Goldman Sachs as the most downbeat ever published by a central bank.

Governor Andrew Bailey and the rest of the monetary policy committee think the UK will suffer a more than 13 per cent inflation peak and that households’ living standards will fall by the biggest cumulative 2-year amount on record.

Those dynamics are set to plunge Britain into a 15-month long recession, the longest since the financial crisis, starting in the final months of this year.

Inflation is already running at 10.1 per cent, more than five times the Bank’s two per cent target.