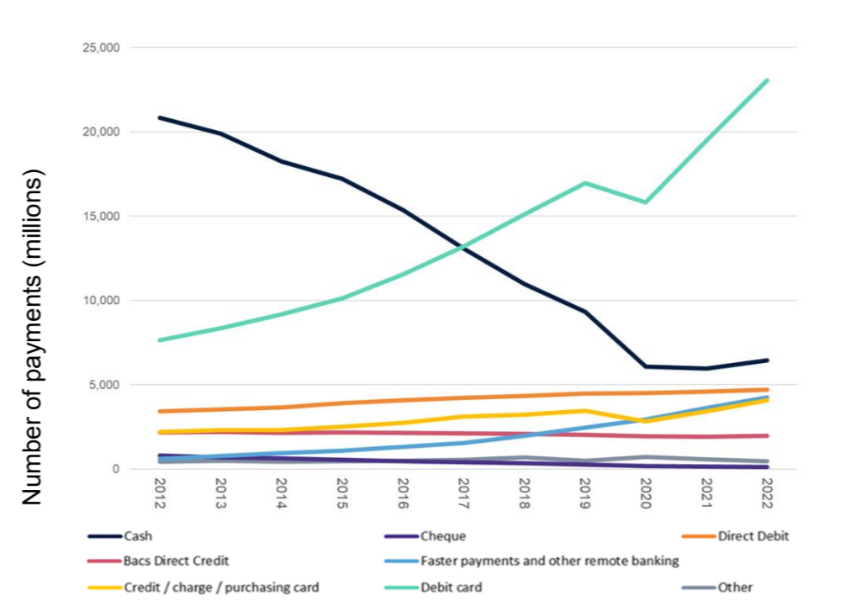

Cash usage increases for first time in over a decade as cost of living crisis bites

Cash payments increased for the first time in a decade last year as concerns over the cost of living crisis prompted Brits to turn to physical currency

The number of cash transactions increased seven per cent year-on-year to hit £6.4bn in 2022, according to a report on the payments market from UK Finance.

“Growing fears about inflation and the rising cost of living have meant some people are making

greater use of cash as a way of managing budgets,” the report said.

The figures reinforce the picture that cash usage has ticked up due to cost of living pressures.

“While the report shows cash in long-term decline it also shows that people have chosen to use it more overall in the current tough economic climate,” Graham Mott, director of strategy at Link said.

Adrian Buckle, head of research at UK Finance, said the trends appear to be following the “pattern that we saw after the financial crisis of 2008/2009 when there was a bit of an increase in cash use but then that dropped away again over time.”

Although the number of cash transactions increased, the share of cash payments continued to fall as the total volume of payments increased.

In 2022 cash made up 15 per cent of transactions with UK Finance predicting usage would halve by 2032, meaning less than seven per cent of payments would be made using cash.

Card payments made up the bulk of transactions. Half of all payments in the UK were made using debit cards, the report showed.

Over 23bn payments were made using debit cards in 2022, an 18 per cent rise on the year before. Credit cards also saw a 19 per cent increase, rising to 4.1bn payments.

Access to cash has become increasingly politicised over the past few months. As part of the Financial Services and Markets Bill, the Financial Conduct Authority was given fresh powers to ensure that banks maintained access to physical currency even while slashing branch numbers.

More than half of the UK’s bank branches, some 5162, have already been wiped out since 2015, according to consumer group Which, meaning that free ATM usage has disappeared with them.