Carillion gives up on unwilling Balfour Beatty

IT WAS a case of third time unlucky for Carillion yesterday, as plans for the ambitious mega-merger between it and Balfour Beatty lay in taters.

Carillion gave up its fruitless hunt for a deal yesterday afternoon following a third rejection from an unswayable Balfour Beatty.

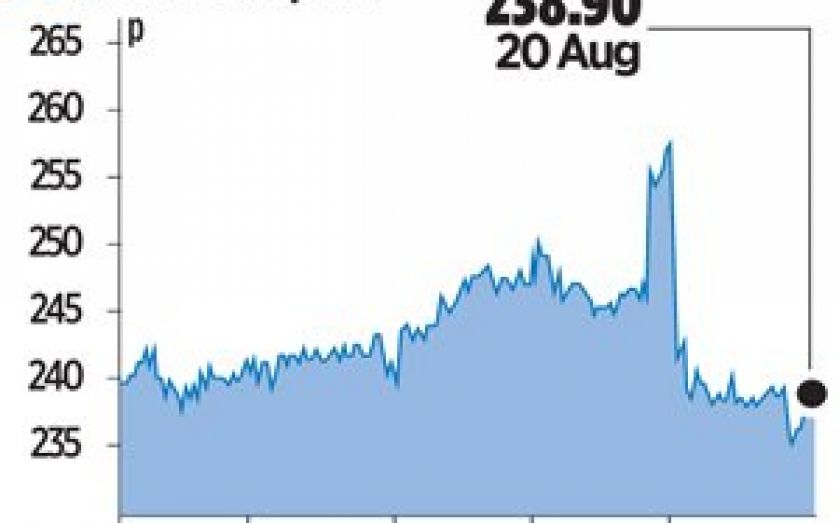

Markets expressed their disappoint as Balfour Beatty shares dived on the news down almost seven per cent on the day, while Carillion also took a hit to its share price as it fell by just under two per cent yesterday.

With a put-up or shut-up deadline due to run out today at 5pm, a bruised Carillion chose to pull the plug early.

Carillion’s last offer to Balfour shareholders of 58.27 per cent in a combined company, up from 56.5 per cent, valued its rival at £2.1bn.

But Balfour rejected the proposal, highlighting serious doubts on Carillion’s plans to reduce the size of the UK construction business at a time the sector was recovering. There was also a key disagreement over the sale of Balfour’s US arm, Parsons Brinckerhoff.

Negotiations between the two rivals had initially been positive, but took a serious and decisive turn for the worse at the end of July, after Balfour Beatty accused Carillion of unexpectedly backtracking on its stance, having previously agreed with Balfour’s planned sale of Parsons Brinckerhoff.