British Land is upbeat after it outpaces rival

BRITISH Land outshone its biggest rival Land Securities yesterday after the property giant reported a strong rise in rents and values across both its office and retail empire.

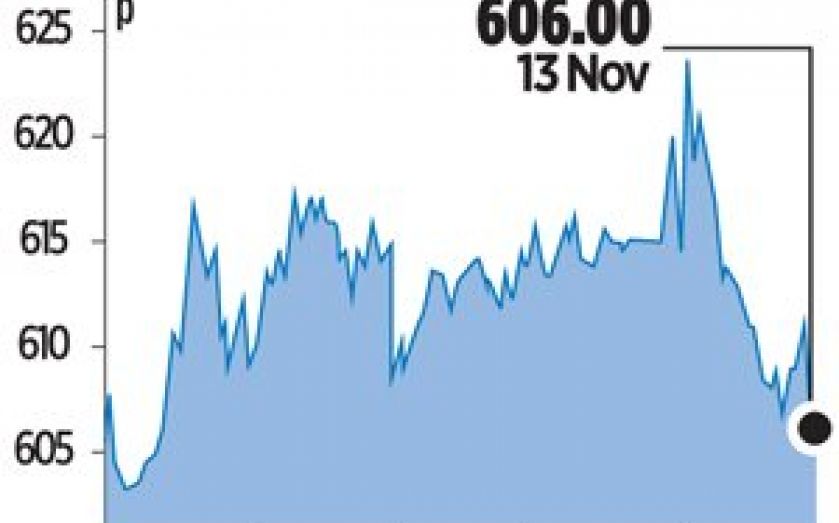

The owner of the Cheesegrater skyscraper in the City said its net asset value (NAV) per share – a key industry measure of performance – rose 4.5 per cent to 623p in the six months to 30 September, beating its larger competitor’s 3.8 per cent growth.

This was boosted by a 2.8 per cent rise in the value of its UK portfolio to £11.2bn from £10.24bn the same time last year. Its retail business grew by 1.5 per cent after 18 months of decline while offices jumped by five per cent.

Chief executive Chris Grigg said it owed some of the success to its decision to increase its exposure to the upmarket West End and more widely to London and the south east.

Britain’s second largest landlord has also ramped up its developments after seizing a major stake in Paddington Central, an offices and shops complex, for £470m and agreeing to develop the massive Shoreditch Estate site with the City of London Corporation earlier this year.

“All of these decisions have positioned us well both for stronger profit growth and total returns,” Grigg said.

The group said it had now spent all £500m raised through a share placement in March, when it also sold Ropemaker Place for £472m.