BP profits tumble 50 per cent on lower oil prices and Deepwater Horizon charge

BP shares are trading 1.19 per cent up in mid morning trading after it reported a 50 per cent drop in underlying profits during the second quarter of 2015, as lower oil prices and the Gulf of Mexico disaster continues to weigh on the company. The figure hit $1.31bn, undershooting analysts’ expectations of $1.6bn.

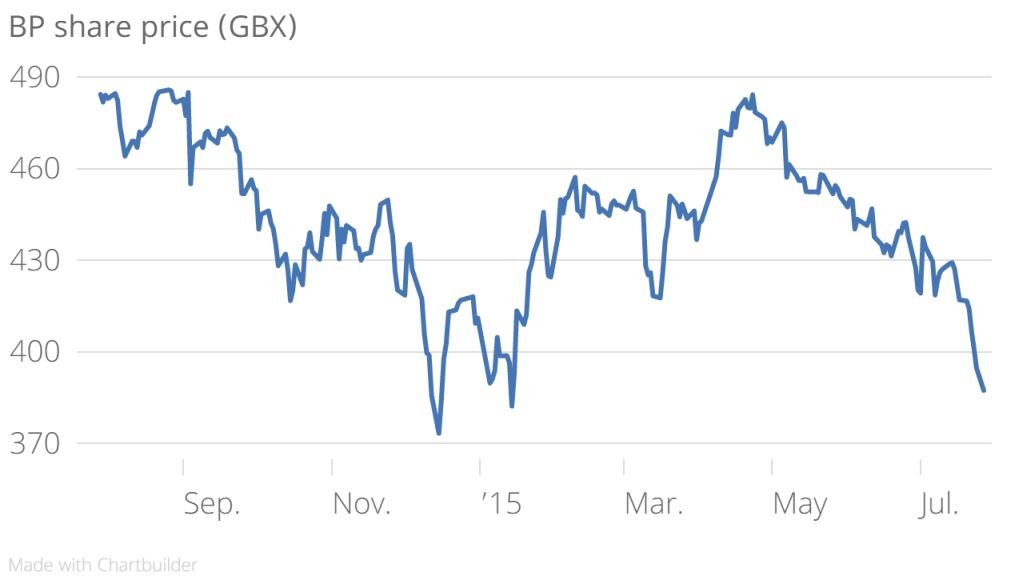

Read more: One chart showing how BP's share price never recovered from the Deepwater Horizon disaster

The figures

Underlying profits for the second quarter fell to $1.31bn (£840m), compared with $2.6bn in the previous quarter and $3.6bn a year ago.

Despite agreeing a "final" compensation payout of $18.7bn for those affected by the Gulf of Mexico disaster, it booked a statutory loss of $5.8bn, down from a profit of $3.4bn during the same period last year – which BP said was largely down to that payout.

Meanwhile, cashflow during the period hit $6.3bn, against $7.9bn a year before, while capital expenditure was cut to $4.7bn in the second quarter, down from $5.4bn in the same period a year ago.

BP also announced a quarterly dividend of 10 cents per ordinary share, expected to be paid in September.

After an initial dip, shares rose 0.72 per cent to 390.1p in early trading.

Why it's interesting

The second quarter figures were made worse by an extra charge the company will take to pay for the latest legal settlement after the Gulf of Mexico oil spill, following the $18.7bn settlement it reached earlier this month with the US government.

The company has struggled with a volatile oil price, with Brent crude tumbling from highs of $115 a barrel a year ago to less than $55 now. Lower crude oil has weighed significantly on earnings growth.

BP shares have fallen 5.7 per cent this year, underperforming the FTSE 100 but faring better than arch nemesis Royal Dutch Shell.

What BP Said

Bob Dudley, BP's group chief executive, said:

The external environment remains challenging, but BP moved quickly in response and we continue to do so. Our work to increase efficiency and reduce costs is embedding sustainable benefits throughout the Group and we continue with capital discipline and divestments.

In the past few weeks oil prices have fallen back in response to continued oversupply and market weakness and the recent agreements regarding Iran. I am confident that positioning BP for a period of weaker prices is the right course to take, and will serve the company well for the future.

In short

BP has reported massive fall in profits as the 2010 Gulf of Mexico oil spill continues to impact on performance in the context of volatile oil prices.