BP plans oil and gas spin-off to compete in US

OIL MAJOR BP yesterday said it plans to spin off its US onshore oil and gas assets into a separate business, to help it compete better in the rapidly changing North American energy market.

The new business will operate separately from the rest of BP, with a different management team.

The changes are intended to make the FTSE 100 firm’s US onshore oil and gas business more efficient and cost-effective, so it can better compete with the onslaught of regional shale players entering the market.

“Our overriding goal is to build a stronger, more competitive and sustainable business that we expect will be a key component of BP’s portfolio for years to come,” said BP upstream chief executive Lamar McKay.

The company said separately yesterday that it is considering requesting a rehearing from US judges, after an appeals court rejected its bid to block businesses from claiming compensation from the Gulf of Mexico oil spill.

By a 2-1 vote, the Fifth US Circuit Court of Appeals in New Orleans upheld a 24 December ruling, meaning BP must restart paying so-called business economic loss claimants, even if their alleged injuries are not traceable to the disaster.

The infamous 2010 Deepwater Horizon oil spill was the largest in US history and killed 11 people.

The company has set aside $42.7bn (£25.6bn) for compensation, legal and other costs related to the spill.

BP originally predicted that it would have to pay out $7.8bn in compensation, but has now revised this estimate to $9.2bn or higher.

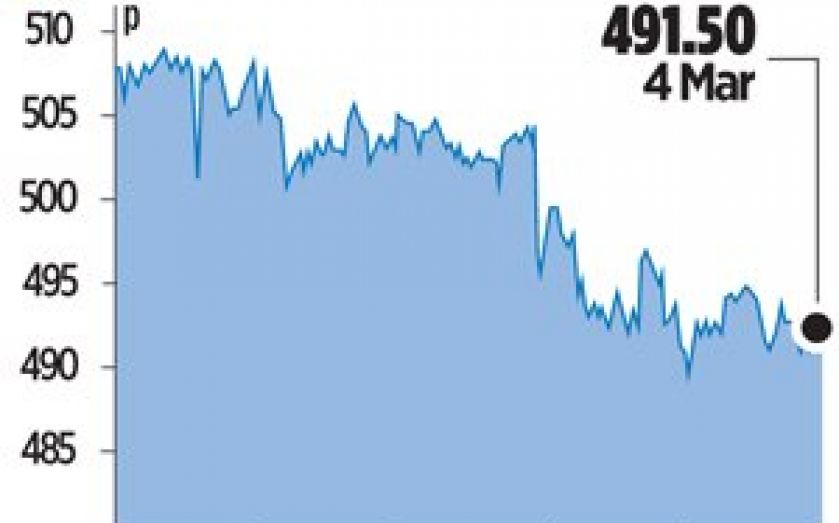

Shares closed down 0.28 per cent at 491.5p.