Bond buying programme drives $100bn out of Europe into the US

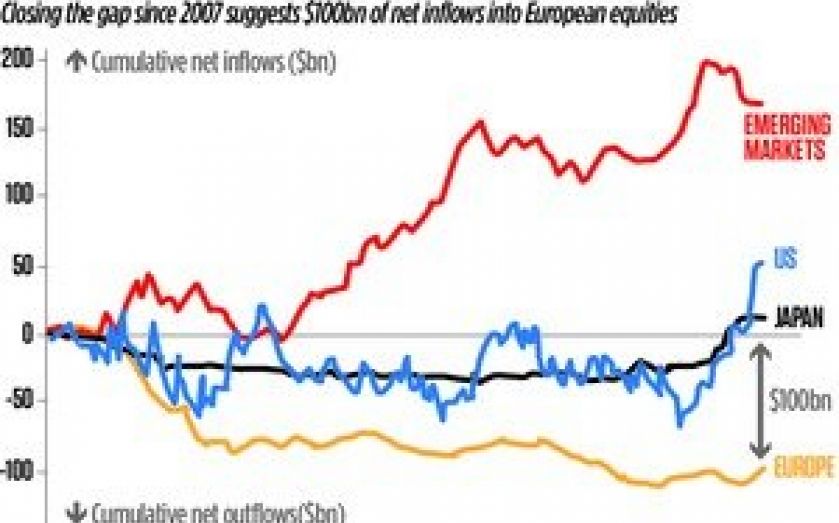

EUROPE has lost $100bn (£64bn) of stock market fund flows since the end of the financial crisis due to the effects of quantitative easing, figures out yesterday reveal.

The $100bn cumulative outflow, the same magnitude as the cash ploughed into the continent following the US Marshall Plan in 1945, is in contrast to the wall of cash currently flowing into US and Japanese funds.

Analysts at Societe Generale, which published the figures, said the outflow had been driven by the Eurozone crisis and Federal Reserve quantitative easing (QE) .

“The difference between Europe and the US is quite startling,” Soc Gen strategist Arthur van Slooten said. “It’s clear over time some regions have definitely benefited in a major way from quantitative easing and Europe is not among them.”

The rollback of Fed QE, known as tapering, is likely to spur a resurgence in European investment, analysts said.

“Now that tapering will set in it’s going to work in favour of European assets. It might not close the $100bn gap very quickly but the momentum from now on should be in favour of Europe,” van Slooten added.

Emerging markets have been the biggest beneficiary of the cheap money, with over $160bn of inflows.