BNP Paribas fined $8,973,600,000 for breaking US sanctions

BNP Paribas’ sanction-busting fine is 13 times the previous record

BNP Paribas was hit with a record $8.97bn (£5.2bn) fine last night for breaking US sanctions from 2004 to 2012, and was condemned in the strongest terms for its persistent criminal actions.

The giant French bank funnelled money from Cuba, Iran and Sudan through the US, disguising its origin to dodge bans on the transactions.

Its wrongdoing was so deliberate, complex and sustained that New York’s southern district attorney Preet Bharara called it “a tour de fraud”.

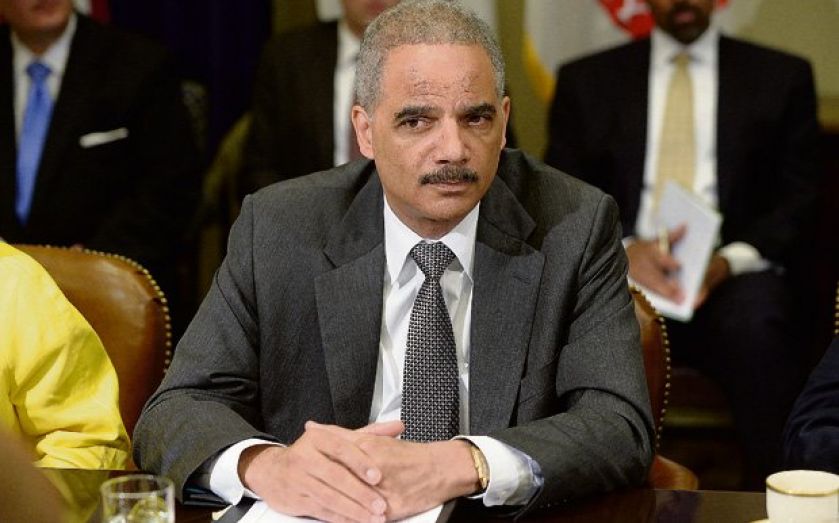

Even when the regulators’ investigation was under way, the bank continued to break the law, “to the detriment of America’s national security interest, despite warnings that its conduct violated embargoes,” said attorney general Eric Holder.

The bank could have reduced the fine and potentially avoided criminal charges, had it co-operated fully.

But instead it “dragged its feet… and concealed its tracks”, said Holder’s deputy, James Cole, and failed to identify those engaged in illegal activity promptly and failing to hand over all relevant documents quickly.

As early as 2005, a senior compliance officer had warned executives that the bank was using a Swiss subsidiary to carry out clearing transactions for the Sudanese government.

The $9bn fine is more than 13 times the previous largest settlement for sanction-breaking – Standard Charter-ed’s 2012 bill hit $667m.

It is made up of $8.8336bn in forfeitures, plus a fine of $140m – totalling $8.9736bn. The payments will be made to a range of regulators, including $508m to the Federal Reserve and $2.24bn to the New York Department of Financial Services.

The bank had initially expected a smaller bill, setting aside $1.1bn for the settlement in February 2014.

Negotiations over the final outcome even reached the Elysee in a startling diplomatic row, with French politicians pushing back against the US action. But the Department of Justice and attorney general refused to back down, eventually forcing French and European leaders to concede the US had every right to enforce its laws against firms operating on its soil.

As well as the fine it will be banned from clearing US dollars through its New York and other branches for a year, representing the withdrawal of a major privilege for the bank.

Now BNP Paribas will have to pay other lenders to clear transactions, and can no longer sit among the world’s leading banks who are able to offer the service.

In addition, 13 staff – including its chief operating officer – will be fired and banned from working for the bank, and could personally face fines.

BNP is pleading guilty to charges of falsifying information and conspiracy to conduct the transactions.

“We deeply regret the past misconduct that led to this settlement,” said chief executive Jean-Laurent Bonnafe, promising to “strengthen internal controls and processes” to stop any repeat of the wrongdoing.