Bitcoin recovery stalls at $40,000 as malaise sweeps alt markets

I’m delighted to announce that I have accepted an Advisory role at MELD Labs and to serve on its Swiss Foundation. As you all know I am a fan of Cardano and this appointment underscores that.

MELD is a non-custodial decentralised and trustless lending and borrowing protocol on the Cardano blockchain. The platform provides fast, safe, and transparent tools for lending and borrowing both crypto and fiat currencies. Take a look at meld.com.

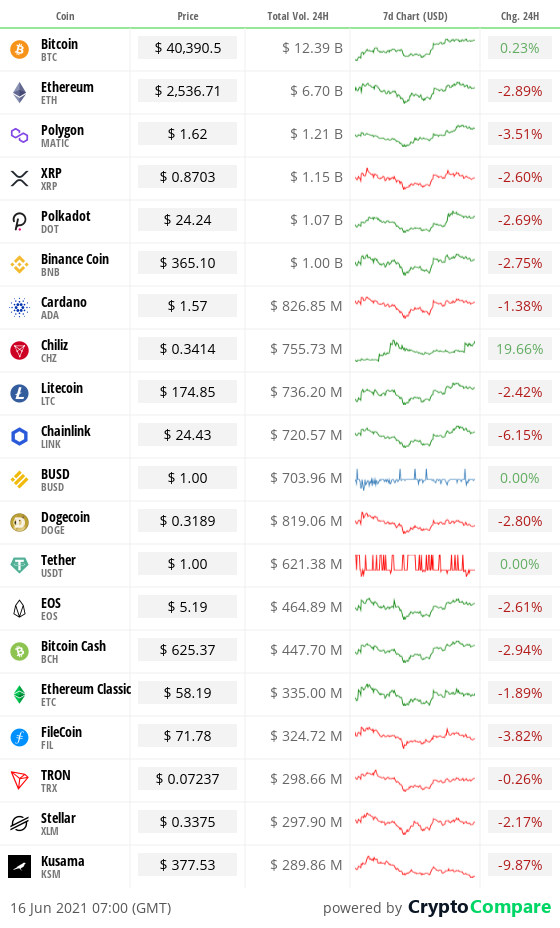

Crypto at a glance

Bitcoin’s recovery appears to have stalled somewhat at $40,000, despite yesterday popping its head briefly above $41k for the first time in nearly a month. The recent positive momentum has been heartening, but Bitcoin is not out of the woods yet and continues to trade in the range it’s been in for a while now. Will the market leader break out of the range and climb toward $50,000 again?

Early Tesla and Amazon investor Tim Draper certainly thinks so, yesterday reiterating his prediction that Bitcoin would hit $250k by the end of next year. Draper cited increased adoption across the board, pointing to the rapid increase in retailers accepting Bitcoin. Are they pie in the sky predictions, or could we be on course?

Bitcoin’s market dominance has been steadily increasing over the past week and continues to do so today, though it’s yet to break 50 per cent again – a level many think it needs to in order for the bull run to be considered resumed. Ethereum is still holding $2,500, but the second-largest cryptocurrency has shown limited indication it could push forward again despite gas fees falling and Goldman Sachs introducing plans to offer Ether options.

This malaise is prevalent throughout the alt markets, which are all down slightly today. Only Dogecoin imitator Shiba is really showing signs of movement , soaring 25 per cent over the last 24 hours. Will people be happy to see it, or has the world had enough of meme dogs?

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit – you can now watch the event in two parts via YouTube…

Part one…

Part two…

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com ??

In the markets

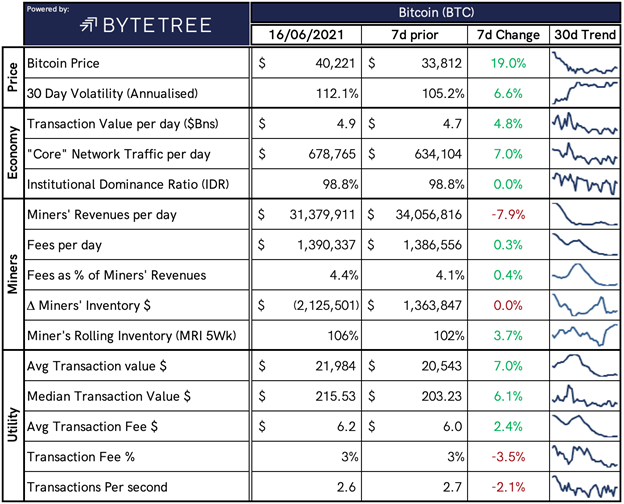

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1,727,228,089,463, down from $1,746,005,595,492 yesterday.

What Bitcoin did yesterday

We closed yesterday, June 15 2021, at a price of $40,155.30, down from $40,536.07, the day before.

The daily high yesterday was $41,295.27 and the daily low was $39,609.47.

This time last year, the price of Bitcoin closed the day at $9,450.70. In 2019, it closed at $8,838.38.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $757.32 billion. To put it into context, the market cap of gold is $11.829 trillion and Facebook is $954.84 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $46,311,599,737, down from $46,534,253,921 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 95.85%.

Fear and Greed Index

Market sentiment today is 33.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 45.99, Its lowest ever recorded dominance was 37.09 on January 8, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 52.85. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

”Bitcoin will be the currency of choice. Bitcoin is not as easy to move around, but eventually, it will be. Then you will have a choice, and you will say: “hey, do I want to pay the banks 2.5% to 4% every time I swipe my credit card, or do I want a currency that’s frictionless, open, transparent, global, and not tied to any political force.”

– Tim Draper, American venture capital investor

What they said yesterday

Africa rising…

Environmental damage…

Like Mike…

Aren’t we all?

Crypto AM editor’s picks

Anonymous say video message to Elon Musk over Bitcoin meddling isn’t theirs

Bitcoin investors are growing weary of Elon Musk’s tiresome tweets

Google slowly opening its doors to cryptocurrency advertising

Cardano bridges the gap to China by teaming up with Nervos Blockchain

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special

Part one of two – April 2021

Part two of two – April 2021

Five Part Series – March 2021

Part one…

Part two…

Part three…

Part four…

Part five…

Crypto AM: Recommended Events

Crypto AM City of London Roundtable

Crypto AM Blockchain & DeFi Summit

Crypto AM Awards 2021

September 29 and 30 2021

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.