Barclays hikes bonuses to hold onto top staff

BARCLAYS has been forced to increase bonuses in a bid to attract the best staff in the US and Asia, where competition is particularly fierce, the bank’s boss said yesterday.

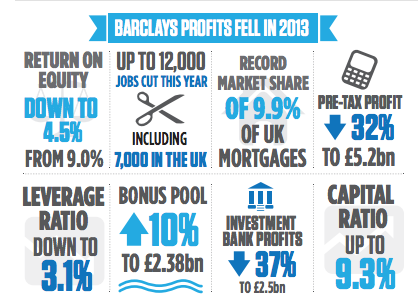

The bonus pool increased by 10 per cent to £2.38bn, even as profits for 2013 fell 32 per cent to £5.2bn.

Chief executive Antony Jenkins said the bank can only stay strong if it pays competitively for the best staff around the world, and that this will benefit shareholders in the long term.

“We’ve seen increased levels of attrition, particularly in the US, and it is harder to hire people into the organisation in certain parts of the business,” Jenkins said. “I recognise the decision will be difficult for some people, and I have a lot of sympathy, but I must do the right thing for shareholders.”

Bonuses come to 38 per cent of the revenue, the same level as last year. Jenkins wants that to fall to the mid-30s in future – but with falling headcount individual bankers may not see pay fall.

However, shareholder group Pirc complained the bonuses are too high, noting the pool is three times larger than the dividend for 2013.

Up to 12,000 jobs will be cut this year across the world, with around 7,000 jobs lost in the UK. And as more customers use online banking, Barclays will accelerate its branch closures from the 33 closed in 2013.

Investment bank profits fell nine per cent to £2.5bn while UK retail and business banking profits fell two per cent to £1.2bn. European losses soared to £1bn, compared with a loss of £343m in 2012.

However, the total stock of mortgages outstanding rose to £122.8bn, up £8.1bn on the year and giving a 9.9 per cent market share, a record high. Mortgage profits are also rising as funding costs dip but interest rates on the loans increase.