Banking stocks are rock bottom, which could mean it’s time to buy

Financials are at bargain basement prices and it could be time to get involved, reports Esther Shaw

Northern Rock has been one of the most spectacular victims of the credit crisis, but much of the banking sector has experienced some stormy weather over the last year.

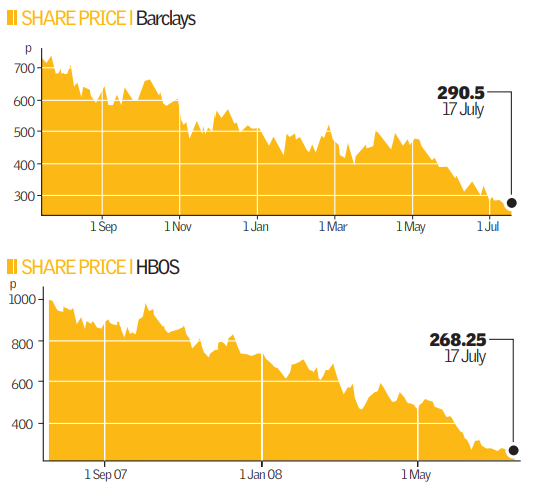

Even large institutions like Barclays and Royal Bank of Scotland have seen share prices plummet between 60 and 70 per cent over the last 15 months. Alliance & Leicester is down 80 per cent from its peak, and Bradford & Bingley is down 90 per cent. Even the strongest bank, HSBC, is down 25 per cent, over concerns about future profitability and margins. This week, banking stocks were at their lowest for 10 years.

But intriguingly, the respected former Fidelity fund manager Anthony Bolton says that it’s time to buy financials again. He suggests a move out of commodities into a basket of UK banks which have already had rights issues – but emphasises that this strategy will take patience.

Not everybody agrees. Hugo Shaw from broker BestInvest dubs Bolton’s recent statements “classically contrarian. His comments are typical of a seasoned investor who has experienced many an up and down during his or her career.” He says that Bolton’s views reflect the City adage of ’buy into weakness.’

Sooner or later, the tide will turn and many financials will regain their former strength, but the key is to call the bottom of the market. “Unless you’re an investment genius – or more likely, extremely lucky – there’s a fair chance you’ll miss it,” warns Shaw.

Call the Bottom

James Norton, chartered financial planner at wealth management firm Evolve Financial Planning, thinks that it is futile to anticipate when banking stocks will have their day again.

“Bolton may be near to calling the bottom for this sector, but other managers have been saying this for months, and have had their fingers badly burned,” he says. There are currently a whole host of fund managers who are far from sure that now is the time to get back into financials.

Some specialist managers, such as Philip Gibbs of Jupiter Financial Opportunities, say that it is still too soon to get back into banks. Almost 30 per cent of his fund is held in cash, with just 16 per cent in UK financial institutions, none of which are actually banks.

Invesco Perpetual’s Neil Woodford, who has been bearish on bank stocks for quite a while, is still steering clear, and has no bank shares in his top 10 holdings, while Newton Income and Antony Nutt’s Jupiter Income are similarly low on bank shares.

That said, Artemis and Rathbone Income Funds both hold Lloyds TSB and HSBC in their top 10 holdings, while Bill Mott has been perhaps the most bullish, with his PSigma Income Fund: he says this is a “once in a decade” chance to buy banking stocks.

Jason Britton, co-fund manager at T Bailey, the specialist fund of fund boutique, characterises the situation vividly.

“Everyone’s trying to decide whether this is the bottom of the market,” he says. “It’s a bit like a budget airline flight – investors are hovering around the boarding gate, waiting for the signal to embark. Delays keep getting announced, but when the all clear is signalled, there will be a huge rush.”

Part of the reason for the uncertainty is the concern that there may be further requirement for capital, and that future margins will be squeezed. But clearly some respected figures see this as the best investment opportunity in a decade. Long-term, they think, these distressed shares will perform well.

Positive Signs

Stephen McClymont, fund manager at Tilney, the UK arm of Deutsche Bank Private Wealth Management, agrees that we are now starting to see signs of others finding value in the banking sector.

“We are seeing this particularly with the A&L deal, but also with the fact that Barclays managed to garner support for its recent fund-raising,” he says. “This shows that there are some who are prepared to look beyond the current gloom.”

The crux of the matter, he adds, is that while we may be getting close to the bottom of the market, “every time you think the worst is behind you, another poor announcement comes.” That said, as an investor, you need to remember that where there’s panic, there will also be opportunity.

“For the opportunistic investor, now may appear a good time to take a punt on the banking sector,” says Ian Murrell from Wills & Co stockbrokers. “However, anyone looking to invest here must take into account the likelihood that there is a lot of unfavourable news still to come out.”

At current levels, he adds, the banking sector certainly appears to be offering significant value – coupled with “mouth watering dividend yields.”

“But you have to take into account the possibility of some dividend cuts going forward,” he says. “That said, on the basis that stock markets are meant to look months ahead, I believe investors should cautiously start to invest in banks.”

Reverse Bubble

Some commentators have likened the current situation with bank shares to a “reverse bubble” where, just as exuberance can propel shares above their true worth, the opposite can happen, and shares in certain sectors can be overly suppressed.

It may be the case that many fund managers are waiting for an inflection point, at which they believe all the bad news has been factored into the price – and a point from which, when reached, the only way is up. If Anthony Bolton is right, and we are halfway through the bear market, then we may see that turning point in the next few months.

The interim reporting season which begins at the end of this month should give us a clue as to how close to the bottom we are, but as nobody really knows, you can really only wait and see. Unless, of course, you are feeling particularly brave.