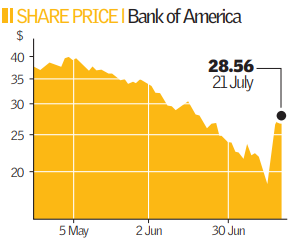

Bank of America adds cheer to bank stocks

Shares in Bank of America, the largest retail bank in the US, surged after the mortgage lender revealed better-than expected second quarter results, despite a 41 per cent drop in profits and a rise in bad loans.

The stock climbed 6 per cent higher after the bank topped earnings forecasts, boosting confidence amongst investors that the worst of the credit crunch was over.

The bank was the fourth American lender to post better-than-expected quarterly results joining Citigroup, JP Morgan Chase and Wells Fargo.

“It suggests the credit crisis isn’t as bad as people thought” for lenders, said Steve Roukis, managing director at Matrix Asset Advisors in New York. “A week ago there was tremendous fear about systematic risk to the system. There’s definitely a floor here.”

Profits for the second quarter fell to $3.41bn (£1.7bn) compared to a record $5.76bn a year earlier. However a higher lending margin, near record investment banking revenues and a $357m trading profit helped to offset the decline in profits.

Profit was 75 cents per share. On that basis, analysts expected 48 cents per share, according to a consensus of estimates. Revenue increased 4 per cent to $20.32bn, topping the average $18.26bn forecast.

The bank said it has set aside $5.83bn for bad loans, up from $1.81bn a year earlier, largely for home equity, residential mortgage and home building exposure.

Chief executive Kenneth Lewis said while he expects credit losses to continue to rise he was not expecting the US economy to slip into a prolonged recession.

Bank of America shares gained 3 per cent to $28.56. Its gains, which come after rivals Wells Fargo, JPMorgan Chase and Citigroup all reported unexpectedly strong results last week, kept broader market losses in check. Although with American Express missing profit expectations US financial stocks are expected to fall today.