Bank of England plays down housing bubble fears – but abnormalities in London present

The Bank of England's Financial Policy Committee (FPC) has denied the existence of a housing bubble at present – but motions that it will remain "vigilant to potential emerging vulnerabilities" (release).

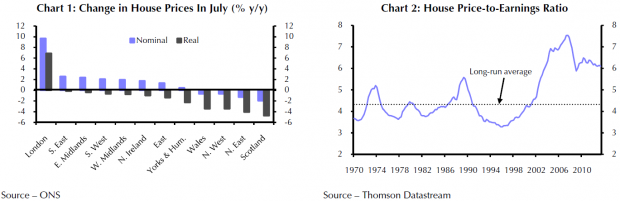

While the FPC sees no immediate troubles with the housing market as a whole, it does highlight regional variability.

Mortgage approvals in July were 30% higher than a year earlier and average house prices in August were 5% higher than a year earlier and had risen more in some parts of the country, particularly London.

A note from Capital Economics suggests that the FPC's approach is one of "words rather than action", while "warnings of a renewed price boom seem premature".

Capital Economics' Martin Beck said that the "growing unaffordability [of housing stock] should act as a natural check on house price growth".

He says that there is "no suggestion that banks are about to return to the very loose lending conditions of the mid-2000s, with 110% mortgages and self-certified loans. So the workings of the market may stay the hand of the FPC in having to intervene."