Acquisitions send Babcock pretax profit soaring 43 per cent

The figures

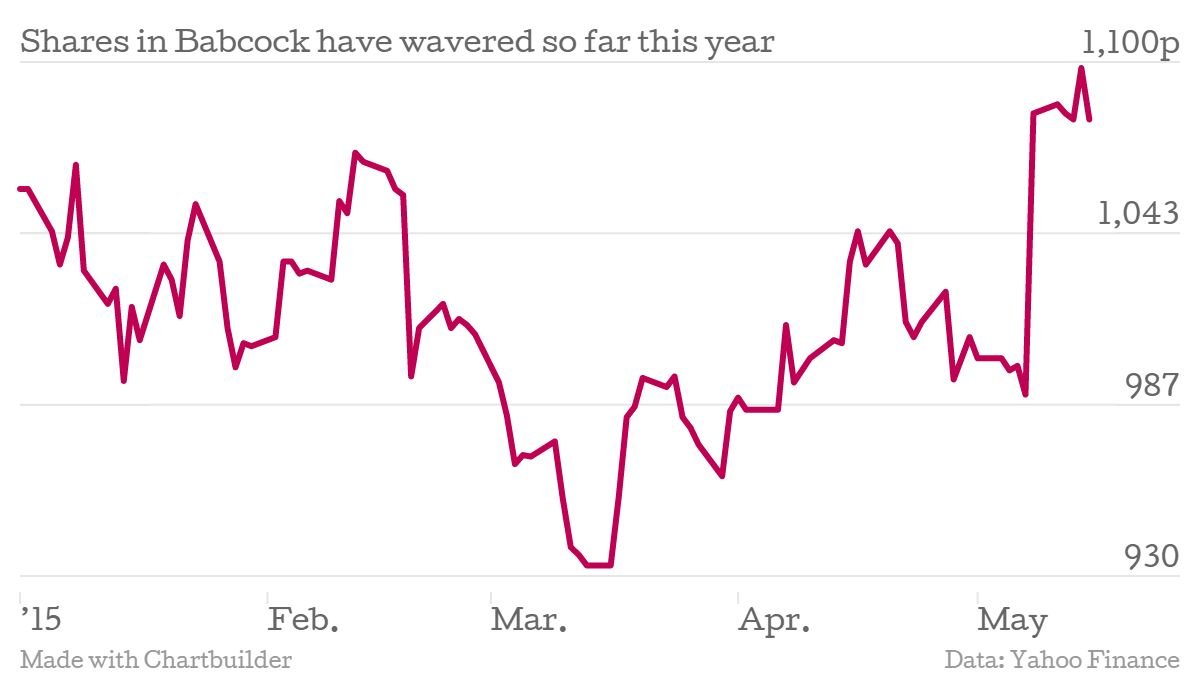

Shares in engineering and support services group Babcock opened 2.52 per cent higher, at 1,108p, after results showed revenue climbed 20 per cent to £3.9bn in the year to March 2015, up from £3.32bn the year before. Similarly, pre-tax profit rose 43 per cent to £313.1m, up from £218.8m a year earlier. Nonetheless, net debt rose to £1.32bn – up from £533.7m a year earlier – due to the acquisition of helicopter operator Avincis, later given the catchy title Babcock Mission Critical Services (MCS).

Why it's interesting

Today's results show Babcock's £200m investment in acquisitions has paid off. That 40 per cent hike in pre-tax profit was driven primarily by its marine technology division, in which revenue rose 13 per cent thanks to the the Ministry of Defence's drive to manage its critical naval infrastructure and assets by outsourcing through a range of long-term partnership contracts and alliance programmes.

"We do not currently anticipate any significant impact to our existing naval marine contracts however, and believe any budget reduction could drive an increased focus on achieving further value for money from future support solutions," it said.

The outsourcer also said new contracts as well as growing existing contracts also helped revenue growth – such as the Magnox civil nuclear decommissioning, London fire brigade vehicle support, defence support group military vehicle support and the maritime support delivery framework.

What Babcock said

Peter Rogers, chief executive, said:

Babcock performed strongly last year, both organically and through acquisitions.

We achieved double digit organic growth in revenue and operating profit driven by major contract wins and by expanding the size and scope of existing contracts. Growth from marine and technology and support services has been particularly compelling.

Our recent acquisitions have continued to perform in line with our expectations and have created an excellent platform for future growth.

We continue to ensure that our financial success is aligned with the interests of our shareholders through the 10% increase in the dividend.

In short

Babcock's full year results were buoyed by a series of acquisitions – meaning its £200m investment paid off.