Allianz sells Dresdner in £8bn deal

German insurance giant Allianz last night agreed to sell its beleaguered banking arm Dresdner to rival Commerzbank in a deal worth €9.8bn (£7.9bn) – a tie up that will lead to at least 1,000 job losses in the City.

In what will be the biggest German banking merger in nearly a decade, Commerzbank will buy Dresdner in two phases, after hammering out an agreement in a series of tense meetings yesterday.

As a result of the tie-up, 9,000 employees will be made redundant, with 2,500 of the cuts coming from outside of Germany.

Its investment banking division Dresdner Kleinwort has been identified as one of the areas that will bear the brunt of job losses, making redundancies in the Square Mile almost certain.

Dresdner Kleinwort employs about 5,500 staff, with 2,000 of those based in the City, while Commerzbank has a smaller corporate markets team of 1,900 staff, with 550 in London, after it scaled back investment banking.

Commerzbank will initially acquire 60.2 per cent of Dresdner with shares and cash and will return to buy the rest of bank before the end of 2009. It will help to fund the purchase by transferring its Cominvest asset management arm, worth around €700m, to Allianz.

Upon completion of the deal, Allianz will become the largest shareholder in the combined Commerzbank-Dresdner, with a 30 per cent stake.

The merged bank will have assets worth around €1.02trillion, giving it the muscle to try and close the gap on market leader Deutsche Bank, which has €2trillion in assets.

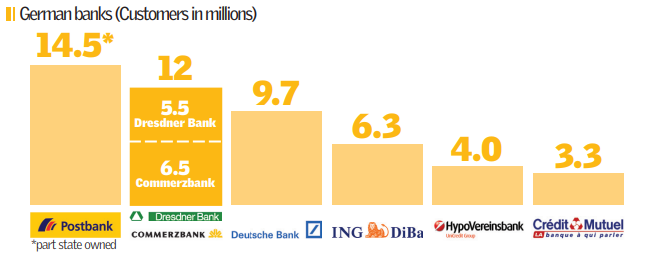

With a combined 1,692 branches, it will have the biggest footprint on the high street, an 11 per cent share in lending and around 12m retail customers in Germany – the most of any private bank, although around 1m of these are shared.

The deal marks the end of Allianz’s troubled seven-year marriage to the loss-making Dresdner, after its $23bn (£12.7bn) acquisition dragged down the firm’s profits and the value of its stock. It has fallen around 61 per cent since it acquired the bank.

Heading up the new bank will be Martin Blessing, the chief executive of Commerzbank who is credited with reviving its fortunes after he reduced its investment banking activities and focused on the consumer sector and lending to medium-sized German firms.