Accounting watchdog announces investigation into KPMG over HBOS

The accountancy watchdog has launched an investigation into KPMG over its audit of HBOS.

Specifically, the Financial Reporting Council (FRC) is looking into the conduct of KPMG Audit relating to its audit of HBOS for the year ended 31 December 2007.

In 2008, HBOS collapsed and needed to be bailed out by Lloyds, shortly after the big four firm had given the health of the business a thumbs up.

A KPMG spokesperson said that the firm had cooperated with all the inquiries and investigations relating to the matter to date and would continue to do so, but "trust and ask that the investigation be completed as quickly as possible".

Read more: Here's how everyone's reacting to the HBOS report

The spokesperson continued:

HBOS reported pre-tax profits of £5.5bn in its 2007 financial statements and continued to raise capital in the wholesale markets well into 2008. Banking analysts continued until August 2008 to expect that it would be profitable in that year.

With hindsight, market conditions all changed with the failure of Lehman in September 2008 and the effective closure of the wholesale funding markets.

Read more: Why HBOS failed: review to be released

Back in 2013, the FRC announced that it had decided to not to open a full investigation into the auditor, but revealed that it was reconsidering the possibility of a probe earlier this year.

The watchdog's decision to reconsider an investigation was announced shortly after a long-awaited report from the Prudential Regulation Authority and the Financial Conduct Authority was published, which was heavily critical of those involved in HBOS' collapse.

In today's announcement, the FCA said it will be examining the appropriateness of the going concern assumption and whether there were any material concerns about HBOS' ability to continue as a going concern which should have been disclosed while preparing the financial statements in question.

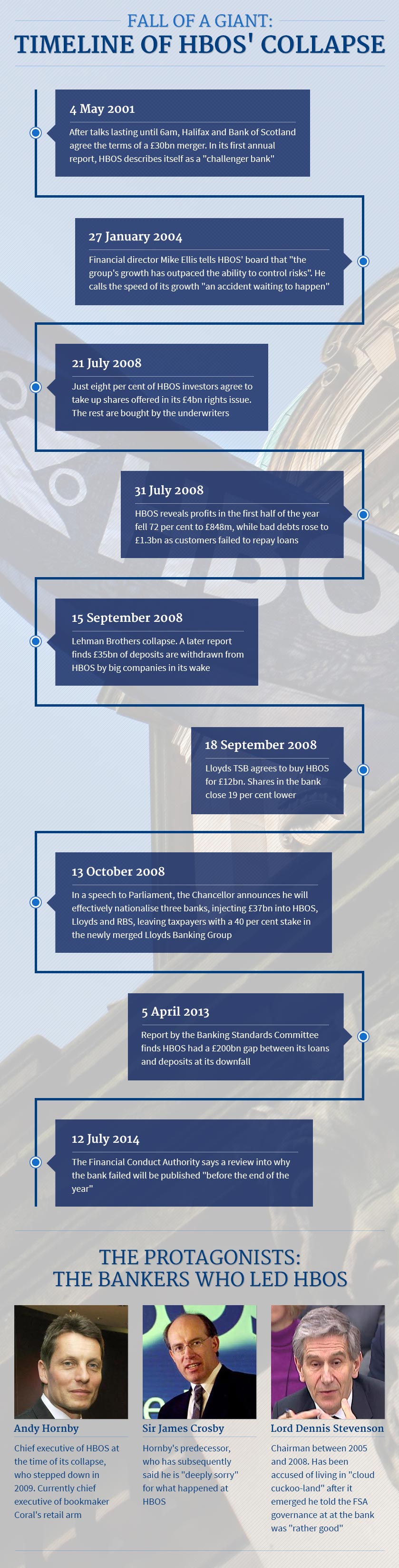

Read more: Fall of a giant: A blow-by-blow account of HBOS' collapse

Commenting on today's announcement, Andrew Tyrie, Chairman of the Treasury Committee, said:

The HBOS report exposed the staggeringly poor quality of HBOS' loan book. The role of the auditors – for years left unexamined – is to be subject to thorough investigation.