Abercrombie share price surges as second quarter beats expectations

Shares in struggling US fashion chain Abercrombie & Fitch surged more than 13 per cent in pre-market trading in New York, after the company reported better than expected earnings.

Sales at the company, which also owns the teen-friendly Hollister brand, dipped eight per cent in the second quarter to $817.8m, but came in ahead of analyst consensus of $812.4m. Earnings per share excluding certain items hit 12 cents, ahead of estimates of a four cent loss.

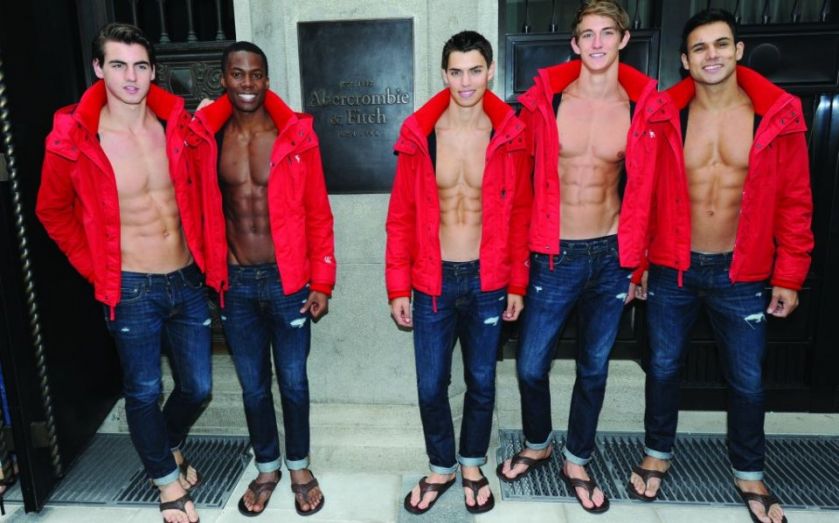

Executive chairman Arthur Martinez said the retailer, famous for its logos and use of scantily-clad male models, was "on the right track" but had some way to go yet in turning around the business which has suffered from falling interest among its teenaged customer base.

In our second quarter, we delivered a meaningful sequential improvement in comparable sales, stabilized gross margins and achieved significant expense reductions. Our results exceeded what we signaled in our first quarter earnings call and give us confidence that we are on the right track, although we recognise that we still have much to achieve.

We continue to take steps to revitalise our performance, maintaining an intense focus on improving the customer experience. We made good progress in Hollister and Abercrombie kids, but more modest progress at Abercrombie & Fitch. To accelerate our efforts, we have reinvigorated Abercrombie & Fitch's brand design and merchandising teams, recruiting a number of talented executives with expertise relevant to our needs.