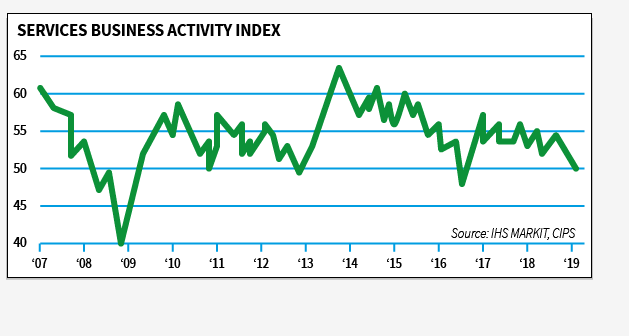

Sterling falls with UK economy ‘at risk of stalling’ as services enter slowdown

The UK service sector lost momentum last month as incoming new work fell for the first time since July 2016, leading to warnings that the economy is close to stalling.

Business activity remained flat in January but fears over the UK’s economic outlook led to a reduction in new employment numbers for the first time in six years, according to the IHS Markit / CIPS purchasing managers’ index.

Read more: Manufacturing PMI improves slightly amid lacklustre business conditions

Firms cited political uncertainty as a reason for the slowdown, with client demand being dampened and decision-making being delayed by Brexit-related concerns.

The pound fell 0.17 per cent to $1.3017 following the disappointing data.

Poor services activity sent sterling lower today (Source: City A.M.)

Aside from a one-off drop in demand following the referendum result in July 2016, last month saw the UK services sector suffer its largest drop in new business since April 2009.

“The latest PMI survey results indicate that the UK economy is at risk of stalling or worse as escalating Brexit uncertainty coincides with a wider slowdown in the global economy,” IHS Markit economist Chris Williamson said.

"Service sector growth ground almost to a halt in January, matching similar disappointing news in the manufacturing and construction sectors," he added.

Optimism in the sector picked up slightly from December's 29-month low but still remained one of the lowest readings since early 2009.

Employment numbers may have reduced slightly, but firms noted higher salary payments were driving up input costs.

Read more: UK construction industry growth falls to 10-month low

"At the risk of sounding like a broken record, Brexit uncertainty continues to be at the heart of the malaise as clients delayed orders and consumers were deeply reluctant to spend under the continuing cloud of hesitation, indecision and ambiguity," Chartered Institute of Procurement and Supply director Duncan Brock said.

"Staff in employment were demanding higher wages, which impacted on input price inflation rising again, so there was a little respite on offer," he added.