UK markets defy Carney

MARK Carney, the Bank of England’s new governor, is increasingly failing to convince markets that he will keep rates on hold for three years.

His new forward guidance and pledge that base rates would remain low for three years, a revolutionary shift announced last week, was meant to push down market rates to lower the cost of mortgages and other private and government loans.

Instead, however, sceptical traders and economists have been pushing up the rate at which the government can borrow – with yesterday’s strong jobs numbers casting further doubt on Carney’s prediction that it will take three years for the unemployment rate to fall sufficiently to allow rate hikes.

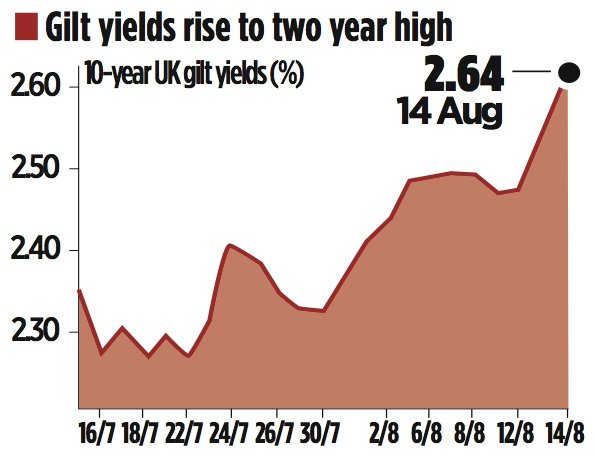

The Bank also revealed that one member of the monetary policy committee, Martin Weale, had challenged the details of the promise to keep rates low. Though he was outvoted 6-1, the news caused sterling and UK bond yields to jump further yesterday. The pound rose 0.41 per cent against the dollar and 0.44 per cent against the euro, while yields on the UK’s 10-year gilts hit 2.64 per cent, the highest since 2011, tightening monetary policy, the opposite of what Carney was seeking to achieve.

Ross Walker of RBS said: “Weale’s dissent will be interpreted by the markets as conveying the clear impression that the Bank’s forward guidance framework is less robust”.

The Bank hopes to hold rates at 0.5 per cent until unemployment falls below seven per cent, but analysts from Deutsche Bank, Saxo Capital Markets and many others believe that unemployment will fall faster. ECM Asset Management’s Alastair Thomas said: “The market seems sceptical of the guidance which has so many caveats and is backed by dubious forecasts”.

But polling shows Carney’s message may be getting through to households. In July, 16 per cent thought the next rise in rates was over two years away, but that proportion has now hit 28 per cent.