UK economy ‘bounces back’ in another signal a recession is off the table but experts warn of stagnation

The UK economy “bounced back” from a sharp contraction over Christmas and is holding up better than feared in another sign the country could avoid a recession, official figures out today show.

Gross domestic product (GDP) jumped 0.3 per cent in January, better than the consensus forecast of 0.1 per cent growth, according to the Office for National Statistics (ONS).

In December, GDP contracted 0.5 per cent.

The resumption of the men’s Premier League after the 2022 Qatar World Cup and children returning to classrooms after an unusual rise in absences over Christmas pushed output higher.

Today’s numbers add to the growing batch of data signalling businesses and households are withstanding the cost of living crisis and are still spending despite inflation racing to a 40-year high of more than 10 per cent.

At the turn of the year, experts at the Bank of England had warned the UK economy was on course to suffer the longest recession in a century which would shave around three per cent off of GDP.

“The economy partially bounced back from the large fall seen in December,” Darren Morgan, director of economics statistics at the ONS, said.

Better than forecast GDP growth will ease the strain on the public finances by raising tax revenues and cut borrowing, although there is speculation the Office for Budget Responsibility has slashed its long term outlook.

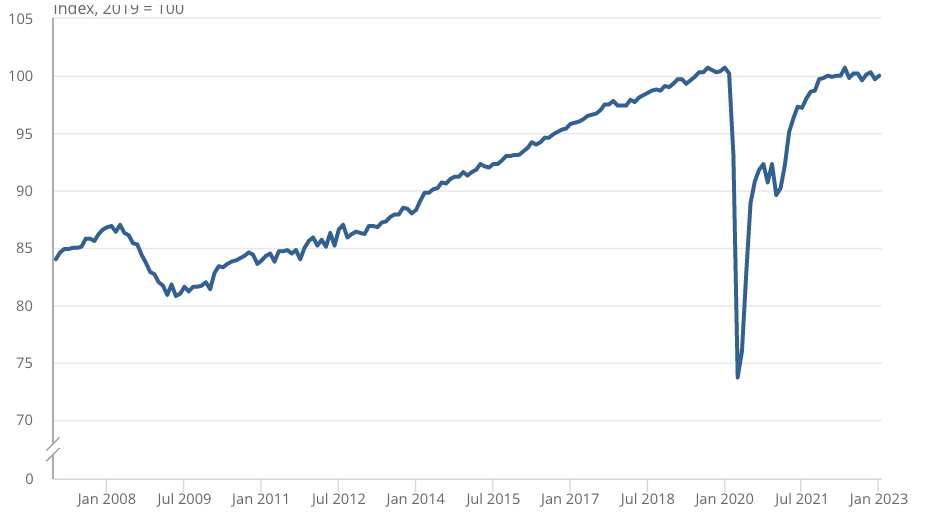

UK economy grew in January but is flatlining

Chancellor Jeremy Hunt is largely expected to launch a tamed budget next Wednesday to keep the books balanced.

“The UK economy has proved more resilient than many expected, but there is a long way to go,” he said.

“Next week, I will set out the next stage of our plan to halve inflation, reduce debt and grow the economy – so we can improve living standards for everyone,’ he added.

Hunt must use next week’s budget – which is poised to confirm the six percentage point corporation tax rise – “to help put Britain on a sustainable growth path for the rest of the year and beyond,” Kitty Ussher, chief economist at Institute of Directors.

Although the likelihood of the economy swerving a recession has grown, the country seems to be entering a period of slow burning stagnation.

“Across the last three months as a whole and, indeed over the last 12 months, the economy has, though, showed zero growth,” Morgan added.

Bank Governor Andrew Bailey and the rest of the team of rate setters do not think the economy will grow at all up until 2025, a warning reinforced in forecasts by the British Chambers of Commerce out this week.

Britain remains the only G7 country with an economy that is smaller than before the Covid-19 crisis.

Analysts said there is still a chance the country will suffer a recession this year despite families being handed a reprieve from tumbling international gas prices.

“This may not be sufficient to stave off a recession in the first half of this year, as consumer spending remains weak with households continuing to be squeezed by elevated prices and higher interest rates,” Yael Selfin, chief economist at KPMG UK, said.

Bailey and co have pumped up borrowing costs ten times in a row to 15-year high of four per cent, the effects of which have yet to fully thread through the economy.