To the Moon

Edging Higher

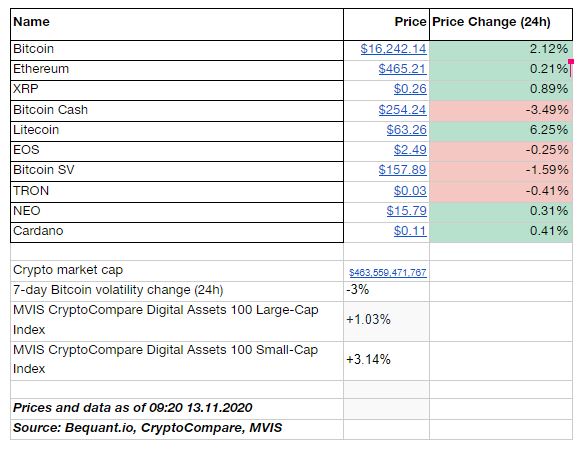

The market continued to edge higher, with Bitcoin attempting to make its way through the congestion area between $16,000, $17,000- $17,150 zone based on 2017/18. Ultimately, the markets are looking to test all-time highs; so much so that resistance before that looks almost futile based on the current risk on sentiment. However, it is this herd like behaviour that also causes over crowded trades and ultimately leads to assets trading at sky high multiples.

Still, looking at equity markets since the initial introduction of Quantitative Easing (QE) by the Fed, there were plenty of instances of stocks trading at multiples unheard of before, yet here we are with the S&P 500 index not far from its record highs. Back to crypto assets and month-to-date, Bitcoin is up 18.5 per cent, while Ethereum is up 16 per cent, which takes Bitcoin year-to-date (YTD) returns to 125 per cent and Ethereum up 251 per cent.

In the Markets

On the March

The aggregate futures open interest (OI) has topped the $6bln mark, with the OI on OKEx creeping through the $1.1bln mark even in spite of the unresolved withdrawal issues.

It is worth noting that the Bitcoin mining pool of OKEX has lost almost all of its hashrate as a result of the aforementioned withdrawal issues (the pool accounted for around 5 per cent before the said withdrawal freeze).

Crypto AM Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Inside Blockchain with Troy Norcross

Crypto AM: Definitively DeFi

Crypto AM shines its Spotlight on CyberFi