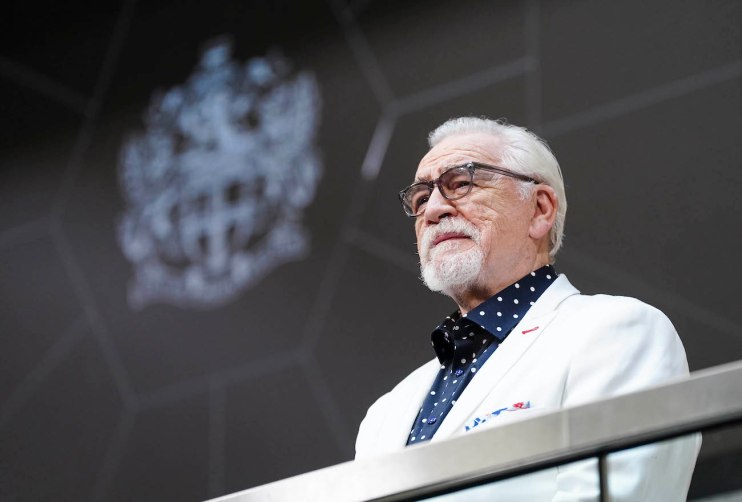

Succession – planning that is – and why you don’t need to be as rich as Logan Roy to secure your family’s financial future

Rivalry and revenge are rife within the Roy family – the dysfunctional clan that returned to screens this week in the Sky series‘Succession’.

Camilla Stowell, head of private and commercial clients at Coutts said: “The drama uncovers how emotional conversations about intergenerational wealth and succession planning can be.

“However, in reality the process can be peaceful, and there are steps families can take to avoid the pitfalls and power struggles seen on screen, to support a lasting positive legacy.

Stowell said if Coutts were advising media mogul Logan Roy, the patriarch at the head of family firm Waystar RoyCo, there are some simple guidelines that he would be encouraged to follow.

Estate planning is not just for the super-rich

“Whilst it sounds grand, estate-planning is simply preparing a plan of action for transferring your assets to your next of kin or beneficiaries of choice in a well ordered, tax-efficient way.

“As you begin reaching life goals such as buying a property, having children, or even start building up significant savings, it’s a good idea to start thinking about the plans that you make for the future and what the purpose of your wealth is. The good news is, unlike the Roys, you don’t need to own a vast fleet of helicopters or private jets before you start putting a plan together. “

Make a will

“According to research three in five (59 per cent) adults in the UK don’t have a will, ” said Stowell. “This means 31 million people, could have no say in what happens to their property, finances and other assets when they pass. Whilst no-one wants to think about their own mortality, a will is the only way to ensure your money goes where you want after you die. Having spent your life working hard and building up your assets, no-one wants to see their hard work undone when they have gone.”

Paperwork! Regularly review your documents

Having made a will, it’s important it is kept up-to-date. Review the document after any major life events such as marriage, divorce, ill-health, the birth of a child etc. Life is constantly changing, and your assets and wishes may change over time too.

And talk: Speak to your family about your plans

Stowell said aavoiding difficult conversations about the future of your estate or business was likely to store up problems in the longer-term and make decisions harder to make.

“As seen with Logan Roy and his family, the longer things go unsaid, the harder it is for relationships to be repaired. Death is a very distressing period and can bring high emotions and stresses around finances. Whilst humans are wired to avoid conflict, communicating your plans with your next of kin means that there is clarity about your intentions and will help for a smoother path when required. This can include aspects such as how you would like your life to be celebrated. Often the more your family knows, the easier it is.”

It’s never too early

“Succession planning is one of the most sensitive and daunting challenges a family business can face. According to the 2018 Global Family Business Survey by PwC, 43 per cent of family businesses don’t have a succession plan, focusing on the long-term instead. It’s easy for entrepreneurs to get into the mindset of ‘my children are too young’, or ‘I need to focus on growing my business.’ However, the earlier you start thinking about the future of your business, the less stressful planning ahead will be. For succession planning to be successful, it needs inter-generational teamwork, so starting conversations early can help iron out any difficulties along the way. Family agreement on the purpose of wealth often ensures greater longevity and impact of it through the generations.”

Do what’s best for the business

Stowell added: “If a business has been in the family for years, there can be a huge emotional push towards making sure it stays that way. Family businesses generate over almost a third of UK GDP and employ 14 million people in the UK, showing how important their smooth-running is to the UK economy.

“Sometimes the next generation is neither willing nor ready to take on this responsibility and the pressure of taking the helm of the family firm can be overwhelming. According to a poll of university students with a family business only five per cent intended to join the firm even five years after graduation. In these cases, it is important to think about whether appointing an external leader would be the right decision. Training your successor before you hand over the reins means that the business is more likely to continue succeeding.”

Take expert advice

Stowell’s urges everyone to seek a second opinion, but make sure it is an expert.

“You would consult a specialist in all areas of your life, such as health or buying property, and finances should be no different. Lawyers, accountants, financial advisers, can help you put together a successful succession plan for your future. There are even companies that specialise in family business succession planning that can help the process of working through any issues.”