Stuart Rose faces huge protest vote

Up to 30 per cent of Marks & Spencer shareholders angry at Rose’s power grab

Marks & Spencer is bracing itself for up to a third of its investors to abstain or vote against Sir Stuart Rose’s controversial plans to hold both chairman and chief executive positions at the retailer’s annual general meeting on Wednesday.

Institutional investors Schroders and Legal & General (L&G) were this weekend understood to be spearheading a shareholder revolt against the flagging retailer over concerns about corporate governance.

L&G refused to comment on the speculation saying it would not disclose how it was going to vote until the meeting. Schroders was unavailable for comment.

Last week four of the retailer’s largest investors – The Universities Superannuation Scheme, Railpen, APG and the Co-operative Insurance Society – who together own nearly 2 per cent of M&S said they would vote against the company’s annual report and accounts over concerns about corporate governance.

The M&S board is preparing for 30 per cent of its shareholders to vote against or abstain from approving Rose’s plans. Roughly 15 per cent are expected to oppose outright and the other 15 per cent are set to abstain.

Meanwhile, M&S yesterday denied reports that it has decided to suspend plans to buy back £600m worth of shares.

“As announced last week we are keeping the scheme under review. Nothing has changed as far as I’m aware,” a spokesman told CityA.M.

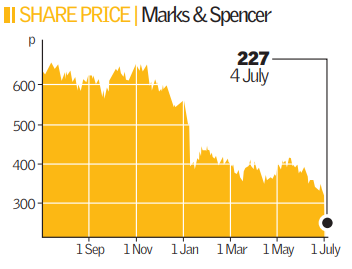

Rose is also expected to come under fire after the group issued a shock profits warning last week, sending M&S’s shares down 25 per cent on the day and wiping around £1.25bn off the value of the company.

The update, which was a week earlier than expected, showed a 5.3 per cent fall in UK like-for-like sales in the 13 weeks to 28 June – the group’s worst quarter since April to June 2005.

Rose said consumer confidence levels had “deteriorated markedly” in the past three months, and with bleak high street conditions likely to continue well into next year, analysts rushed to downgrade forecasts. Many believe M&S food to be over-priced.