Shell’s shares rise on FTSE 100 after predicting upturn in LNG output

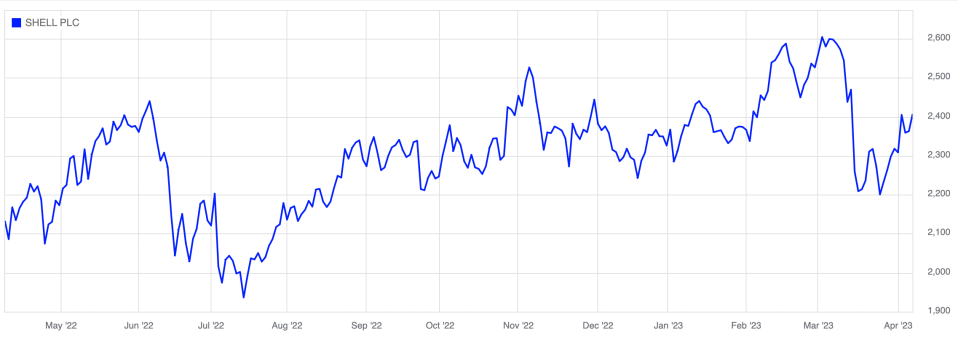

Shell’s shares have risen on the London Stock Exchange this morning, after the energy giant unveiled a bullish update for its first quarter of trading ahead of its results next month.

The FTSE 100 company is currently up 1.65 per cent – trading at £24.02 per share – with investors encouraged by robust forecasts for liquefied natural gas (LNG) output in the first quarter.

It said it expected higher LNG output than last year and stable earnings from trading after outages at its Australian plants last year.

Shell now anticipates first-quarter liquefaction volumes of 7m-7.4m tonnes, up from 6.8m tonnes in the previous quarter.

The world’s biggest fuel retailer also revealed that its oil products division is expected to generate boosted earnings through a “significantly higher” trading performance, alongside its chemicals business.

Overall, Shell expects to have produced more oil – between 930,000 and 970,000 barrels of oil equivalent per day, up from 917,000 in the last quarter of 2022.

Meanwhile, its renewables unit is set to contribute as much as £561.8m to adjusted earnings, compared with £240.7m in the last quarter of 2022.

In terms of taxes, it expects to have paid between £2.1bn to £2.7bn in tax for the first quarter, down from £3.5bn.

Overall, it predicts corporate adjusted losses to widen to between £721m and £960m, from £461m in the last three months of 2022, partly due to ‘one-off tax charges’.

The headline predictions come ahead of its first quarter results on 4 May, after posting record £32.2bn profits last year powered by soaring oil and gas prices following Russia’s invasion of Ukraine.

LNG is is natural gas that has been reduced to a liquid state, through a process of cooling before it is later converted back into a gas for use.

It has become increasingly vital to European energy supplies since Russia began throttling the amount of gas it was sending to the continent in 2021.

Shell’s LNG ships account for around 11 per cent of the global fleet – making a leading player in the industry.

Reflecting its growing role in the energy sector, Shell announced it would combine its oil and gas production division with its LNG business as part of a new shake-up overseen by its new chief executive, Wael Sawan.

Meanwhile, the group’s downstream business, which includes oil refining and delivery to customers, will be combined with its renewables operations.

This will be overseen by current downstream director Huibert Vigeveno – with the changes set to take place in July.

Meanwhile, Ovo Energy has reportedly made a bid for Shell’s domestic retail business, which supplies 1.4m homes across the UK.

Ovo and Shell have both declined to comment on the reports.