Shareholders speak up for Alliance Trust

SMALL shareholders are speaking up in favour of Alliance Trust’s management, and against the bid by activist investor Elliott Advisors to add three new directors to the board.

One individual investor from Norwich told City A.M. that the existing board represents good behaviour and values which have disappeared from some other finance firms.

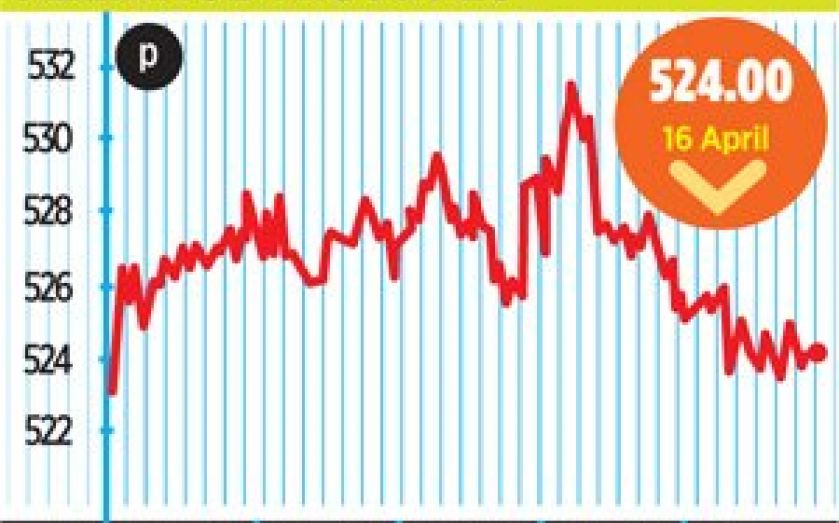

“Returns have been good as a private investor – the share price has been good, dividends are good, transaction costs are low,” said Nigel Cushion, a shareholder and customer.

“Alliance Trust is a fantastic example of a traditional company with high values, an that is worth protecting. As a customer, you get a sense of their tradition, independence, integrity.”

And fellow shareholder Tony Cameron said he does not believe Elliott’s values fit his own.

“Two-thirds of Alliance Trust is owned by small investors like me. I’m not sure Elliott and its backers have the same interests at heart,” said the pensioner from Edinburgh, who has held shares in the firm for more than 20 years.

Investors will vote on the motion at the annual general meeting on 29 April. As yet, the outcome is highly uncertain – Alliance Trust has an unusually high number of small shareholders, rather than large institutions, and so Elliott cannot simply gain support by winning over a small number of individuals.

However, Elliott has the backing of Institutional Shareholder Services (ISS), which advised investors to back Elliott’s plan and argues Alliance has underperformed over the past decade and also maintains a messy structure.

“Either the board has failed to challenge the status quo, or failed to adequately explain why the status quo is preferable,” ISS said.

“In either event, it seems clear that change is warranted at Alliance.”