Risk savvy: Why simple rules of thumb are best

A new book lays bare the pitfalls of complex decision-making.

Imagine you’re a turkey – one that understands basic probability theory. Each day, a farmer brings you a bucket of corn, and any initial wariness over the human’s presence turns into an expectation that you’re about to be fed. This confidence increases week by week, until after 100 days you’re almost certain that the farmer’s arrival means dinner. But it’s the middle of December, the probability model fails you – you’re summarily slaughtered and end up on someone’s plate come Christmas.

For Gerd Gigerenzer of the Max Planck Institute for Human Development, individuals and businesses tend to act a lot like the ill-fated turkey when it comes to decision-making and risk assessment. Confronted by an uncertain world, we flounder with statistical calculations and complicated decision frameworks, drawing false comfort from the air of technical rigour.

It’s a familiar theme. The turkey allegory is borrowed from Nassim Nicholas Taleb (author of The Black Swan and professional gadfly to the economics profession). And the popular triumph of experimental psychologists Daniel Kahneman and Amos Tversky has seen psychological biases and our error-strewn decision-making thrust into the public policy debate.

ROUGH AND READY

But where Kahneman and Tversky’s writings have been taken as a message of despair (we’re just bad at making decisions, and need to be “nudged” to get things right), Gigerenzer wants to empower people and businesses with simple heuristics, or rules of thumb, to navigate our uncertain futures.

There are a lot of enemies in Gigerenzer’s book (including overconfident bankers, consultants and politicians) but none come in for more criticism than those in medicine who fail to communicate risks transparently. In 1995, for example, the Department of Health notoriously announced that the contraceptive pill doubles the risk of thrombosis. It failed to say that the risk was doubled from a mere one woman in every 7,000 to two in 7,000. It’s been estimated that the announcement led to an additional 13,000 abortions in England and Wales the following year.

Hence the first rough and ready rule for better decision-making: don’t be swayed by misleading statistics; always scrutinise the claims, asking for the absolute risk levels rather than just proportional increases.

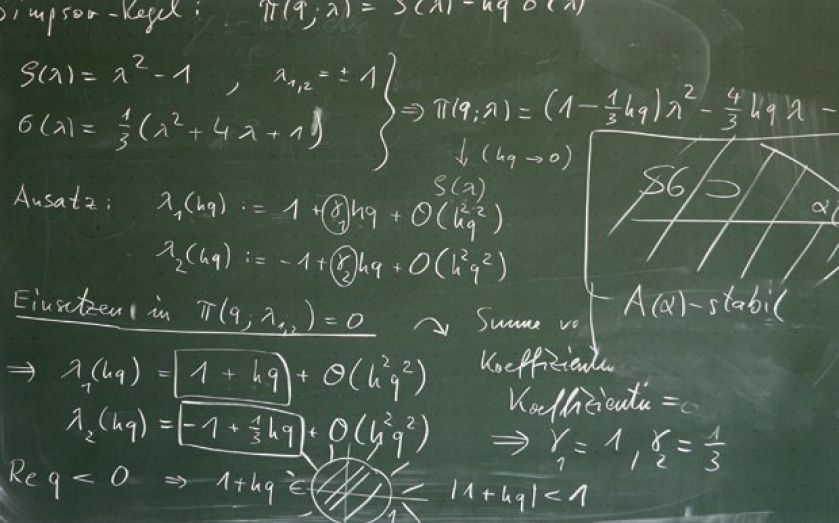

THE CULT OF BIG EQUATIONS

Statistical methods grew out of astronomy – but unlike planetary systems, the economy has a habit of surprising even the most sophisticated analyst. Investment banks called the 2007 credit crunch a 25-sigma event – something that should occur once in 100,000 years, but actually happened several days in a row. According to Gigerenzer, it’s all too easy for such calculations to blind businesses to risk.

Instead, the risk savvy (like Nobel Prize winning economist Harry Markowitz) make decisions based on stripped-down rules of thumb. The father of modern portfolio theory, Markowitz shunned his famed optimising methods when it came to his own money, favouring a far simpler “one over ‘n’” technique, splitting capital equally across the different investment options. Perhaps this was hypocritical, but at least he wasn’t a turkey.

Make email sorting fun

Email Game

Free

It’s easy to spend hours sorting through emails, and the experience can be a soul-destroying one. Latching on to the “gamification” trend, this Chrome browser extension enlists a bit of friendly competition to help speed things up. Timers help to improve your focus while wading through spam, while point scoring is used to give an immediate sense of gratification for tasks completed. You can even add friends to compete, and see who can earn points and empty their inbox the fastest.