How reinvesting FTSE 100 dividends has affected Isa returns since 1999

Reinvesting dividends is one of the most powerful tools available to boost returns over time. Investors in the FTSE 100 would certainly have noticed the difference over the last 18 years.

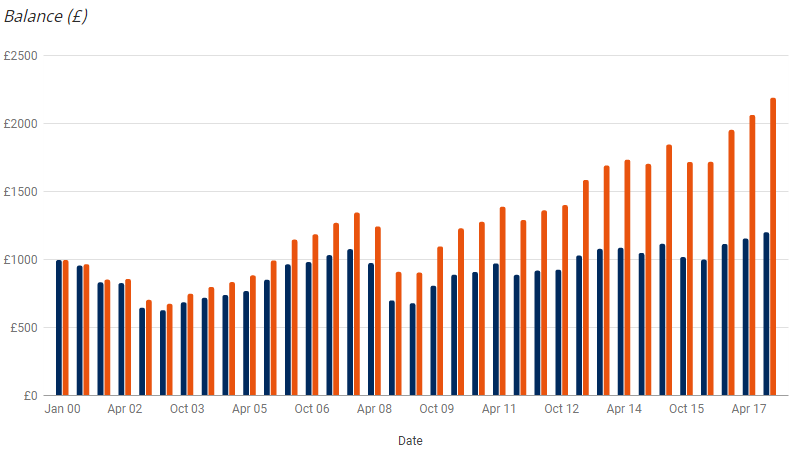

For instance, if you had invested £1,000 on 31 December 1999 in the FTSE 100, the capital growth would have produced a notional return of £204 (by November 2017). Annually, that represents a growth rate of just 1.1%.

But the picture changes again once dividends and the miracle effects of “compounding” are included. By reinvesting all dividends, the same £1,000 investment in the FTSE 100 would have produced a notional return of £1,193, representing annualised growth of 4.6%.

In percentage terms, it’s the difference between your money growing by 20.4%, without dividends reinvested, or 119.3% with dividends reinvested.

The reason for this stark difference in returns is the compounding effect, where you earn returns on your returns. This can snowball over time to produce far more than you might expect.

For the calculations, we have used a timeframe starting at the end of 1999 when the market was at a high. It was also the first year of Isas, or Individual Savings Accounts.

Isas are a popular way to invest and make dividend reinvestment more tax efficient. Isas can be used to hold shares, bonds or funds, or for cash savings (more is explained below).

The chart below illustrates the effect dividend reinvestment has on your investment over time. The blue bars show the return on the FTSE 100 excluding dividends. The orange bars show the return on the FTSE 100 including dividend reinvestment (total return). Starting off at the same base the investment in the total return index grows quicker as the years go on.

The power of dividend reinvesting

Please remember past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

Source: Schroders. Thomson Reuters data for the FTSE 100 and the FTSE 100 Total Return (including dividends) correct as at 21 November 2017. Indexes have been rebased to 1000 to provide accurate comparison the converted into sterling returns.

Why dividends are important

Low interest rates, part of the measures deployed by central banks to revive flagging Western economies following the global financial crisis, have driven down yields on more traditional sources of income such as government bonds (gilts) and savings accounts.

For instance, the UK interest rate is currently 0.5% and the yield on a 10-year gilt is 1.29%, according to Thomson Reuters data. Both were more than 5% in 1999.

By comparison, the dividend yield on the FTSE 100 is currently 3.9%, which is why income-hungry investors have turned their attention to stock market dividends.

Why could dividend reinvestment be effective?

When purchasing a share, investors can elect how they will receive any future dividends. They can choose to receive cash, referred to as income, or use that money to repurchase more company shares, which is known as accumulation.

Investors must elect to repurchase (accumulate) more shares to trigger the start of a process Albert Einstein called “the eighth wonder of the world”: the miracle effect of compounding.

- Cash Isa vs stockmarket Isa: which has returned the most?

- Why companies that cut their dividend can be attractive income investments

Compound interest, put simply, is interest on interest and it can help an investment grow at a faster rate. By reinvesting dividends, you give your stock holding the potential to earn even more dividends in the future.

Of course, the value of compounding increases over time, accelerating shareholder value, especially when share prices increase.

Beware of the dividend trap

It is important to remember companies do not have to pay dividends and dividends can be cut or cancelled at any time.

Some companies even borrow money to pay dividends, to keep investors happy. This is not always a sustainable approach.

Borrowing money to pay a dividend could be a symptom of a company with a weak balance sheet. It is advised that investors do their due diligence before they make any investment.

Nick Kirrage, an equity value fund manager at Schroders, said: “Dividend reinvestment is one of the most powerful investment tools available. As our research shows, the potential difference to the rate of return dividend reinvestment makes could be substantial.

“In an era where interest rates are so low investors need to be aware of relatively simple investment techniques that can help them build up their returns. Dividend reinvestment is a simple technique.

“Over time, those seemingly small amounts reinvested can grow into much bigger sums if you use them to buy even more shares of stock that pay dividends in turn.

“Investors need to do their research and make sure the company they are investing in can afford to pay their dividends on a sustainable basis. Your original capital is also at risk, so it pays to be picky.

“As a way of building up your investments dividend reinvestment can be powerful.”

What is an Isa?

‘Isa’ stands for Individual Savings Account. It is a tax-efficient account into which anyone over the age of 18 can save up to £20,000 a year and withdraw the proceeds, at any time, tax-free. They can elect to keep their savings in cash and earn interest or they can try to get better returns and invest in stocks and shares.

There are pros and cons to both. If you leave your money in cash then up to £85,000 is protected by the Financial Services Compensation Scheme (FSCS). Cash returns have historically been lower but they provide more assurance.

Investing your money into financial markets might offer the potential of higher returns but it also comes with the risk that you could lose all your money.

Important Information: The views and opinions contained herein are those of David Brett, Investment Writer, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This communication is marketing material.

This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. Issued by Schroder Investment Management Limited, 31 Gresham Street, London EC2V 7QA. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.