A recovery built on bricks and mortar

Bovis chief executive David Ritchie tells Elizabeth Fournier why he’s not concerned about a new UK housing bubble

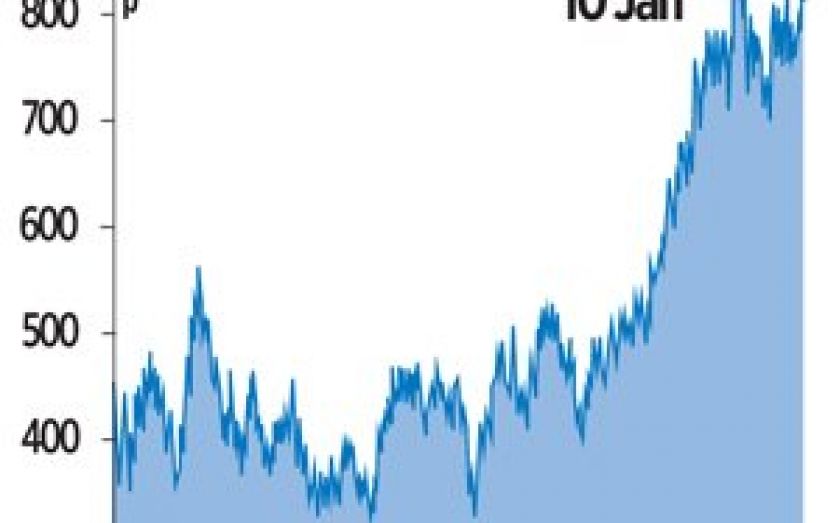

THE LAST 12 months have been good ones for Britain’s housebuilders. After a financial crisis that saw billions wiped off the sector as credit dried up and house prices crashed, 2013 saw a return to form as more confident buyers rushed to take advantage of government guarantee schemes and new mortgage products.

For David Ritchie, chief executive of FTSE 250 housebuilder Bovis, it has been a welcome change of pace. Named CEO in July 2008, Ritchie took the reins at Bovis during what he calls “the worst of the housing market downturn” – 60 per cent of the group’s workforce had been cut, and just 100 of its new-build properties had been sold in the entire second quarter, a tenth of normal volumes.

“It was catastrophic,” says Ritchie, a 44-year old Scot who trained as an accountant before entering the boardroom. “On occasions we would come to the end of a week and not have sold any houses; that’s not a great feeling.”

It was hardly the ideal situation to walk into, but Ritchie insists he was happy to take on the challenge.

“You don’t always get to come into a flying, buoyant market, but it was a good opportunity to come in and make a lot of changes. We’re a much better business five years on now than we were then, because we were encouraged by the downturn to look inwards and make decisions about how to run the business differently.”

Ritchie first joined Bovis as group financial controller in 1998, having helped the firm come to market while at previous employer KPMG. Four years later at just 32 he stepped up to become finance director. It’s a role he admits he initially saw as a stepping stone to a similar job in a larger company, but when former chief executive Malcolm Harris stepped up to become chairman, he took an even bigger step. His early months in the job saw a complete shake up of the business, including not only dramatic staff cuts, but also the decision to put a complete halt to the two things that define a housebuilder’s modus operandi; buying land, and building houses.

“We call it the cash-up period,” explains Ritchie. “If you have built a lot of houses and bought a lot of land, the one thing you can do is stop buying land, and stop building more houses. The ones that you have built you can keep trying to sell – and then every pound that you get from a customer, even if it’s a low price, is 100 per cent cashflow.”

The strategy meant that during 2009 Bovis generated a third of its net worth in cash, adding £220m to its balance sheet and leaving it perfectly placed to take advantage of the plummeting land values that the bottom of the market offered. Today, it has around 15,000 plots of land that have consent to build on – land that Ritchie says will keep it going for the next five years or so. With government targets for new homes set at well over than 200,000 every year for the next decade, that number might sound low, but Ritchie insists UK developers are building as fast as they can.

“The sales rate in the market means selling more than 50 homes per site a year is very difficult. Even if we could build faster, in the whole of the UK there are only 350,000 plots of land out there with consent for a home – just over one year’s government number on housing need – we’d be out of land with consent very fast.”

And despite the term “housing bubble” re-entering the British lexicon since the introduction of the government’s Help To Buy scheme was announced last April, Ritchie says the significant uptick in housing activity was already well underway – mainly thanks to the earlier funding for lending initiative, which was recently narrowed to exclude mortgage products.

“The redirection of the scheme to focus on small business lending is a good sign of the improved confidence in the state of the housing market,” Ritchie says of the decision, which knocked billions off the UK’s housebuilders when it was announced last November.

He says the effect of the second phase of Help To Buy – equity loans available to first-time buyers and movers on new-build homes worth up to £600,000 – are yet to be seen, but believes that fears over rising house prices are overblown, particularly outside London. “The capital is such a microcosm,” he says. “If you take London out of the house price numbers growth would be much, much lower.”

CV DAVID RITCHIE

■ Born in 1969 in Falkirk, Scotland

■ Qualified as a chartered accountant and worked for KPMG in Bristol, where he helped Bovis with the firm’s 1997 stock market flotation

■ Joined Bovis in 1998 as group financial controller

■ Promoted to financial director in 2002

■ Named chief executive in 2008