Plus500 plotting deals spree as it readies £138m payout to shareholders

Retail trading platform Plus500 said it is “actively” looking to strike new deals today as it ramps up its global expansion plans amid a slowdown in trading and squeeze on profits.

In its full year results this morning, the London-listed Israeli fintech said revenues came in at $726.2m in 2023, down 13 per cent on the previous year, while earnings before deductibles slumped 25 per cent to $340.5m after another growth push into the US and Japan.

The firm topped market expectations however after analysts predicted revenues of $645.2m and profits of $299.8m for the full year.

The tumble in earnings comes as amateur traders are squeezed by inflation and look to save cash and sit out volatility on the markets.

Despite the slowdown, Plus500 said it would return $175m to shareholders with a new share buyback programme of $100m and dividends of $75m over the coming year. The fresh capital return follows some $350m of total buybacks and dividends in 2023.

Plus500 boss David Zruia told City A.M. the firm was also looking to now funnel cash into further deals as it ramped up its expansion plans.

“We will very much continue with the bolt-on acquisitions that we were after and we are after,” he said in an interview. “Strategically, Plus500 is in a great position to extend itself organically, but also through acquisitions. So yes, we are looking actively for such acquisitions and this is something that we will look to deliver.”

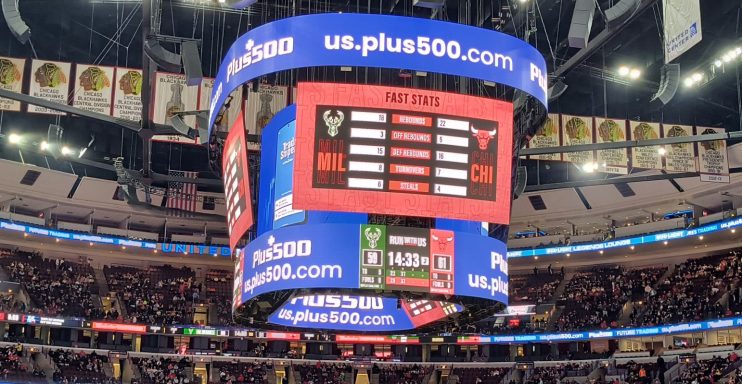

Plus500 has struck a number of deals in the past three years to push into new markets. In 2021, the firm entered the US market through its acquisition of Cunningham Commodities and expanded into Japan two years ago by snapping up local firm EZ Invest.

Zruia declined to say which firms the company was in talks with.

The growth plans come as Plus500 grapples with a volatile share price. The London-listed outfit is trading down 0.65 per cent over the past year but has rebounded some 40 per cent since October.

Plus500 made headlines last year as it lambasted London investors over its valuation and said it was mulling a dual listing in New York, where tech firms are typically seen to fetch higher prices. Zruia said London investors had failed to value his company as a fintech firm and viewed it as a finance company, which had weighed on its value.

Speaking with City A.M. today, Zruia doubled down on the move and said the firm would explore listing in the US when markets settle.

“We will consider in due course other alternatives – obviously now it’s not the right timing due to the market conditions,” he said. “As we need to build our business and make it stronger and bigger in the US and in the future, we will consider consider [New York].”