Before the open – 31/07 – Investor caution ahead of Fed policy meeting, Japanese real wages fall

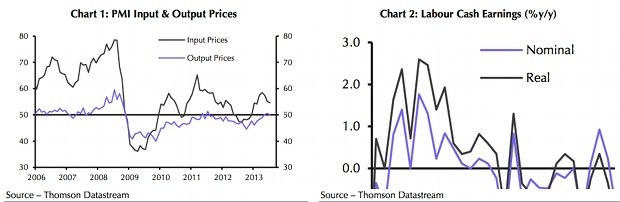

The Nikkei fell on a raft of poor data last night, including the first drop in manufacturing purchasing managers’ index (PMI) since late last year and wage growth remained below rising inflation.

Nomura’s measure of manufacturing PMI fell from 52.3 to 50.7 in July (where above 50 indicates growth), while labour cash earnings rose just 0.1 per cent annually in June, falling below the 0.2 per cent expected. Accounting for inflation, real wages fell by 0.2 per cent. Bonuses were up just 0.4 per cent.

Source: Capital Economics

Meanwhile, Chinese shares were up after Beijing promised to keep economic growth steady, but was moderated by caution ahead of the US Federal Reserve policy meeting later today.

The FTSE is expected to open slightly up today.

Traders understandably cautious today, US closed flat(ish) last night, looking at a similar scenario in Europe. FTSE +10, CAC -5, DAX -7

— Craig Erlam (@Craig_AlpariUK) July 31, 2013

FTSE triangle surely done now?! I'll be glad to see the back of this correctional phase. Looking long on open, especially on a dip. ++

— Elroy (@elroytrader) July 31, 2013

Key events today:

German July unemployment at 08:55. Rate expected to stay flat at 6.8 per cent (a fall of 4,000 people).

Italian June unemployment at 09:00. Expected to increase from 12.2 per cent to 12.3 per cent.

Eurozone July inflation figures at 10:00. Expected to increase from 1.6 per cent to 1.7 per cent (core CPI expected to rise from 1.2 per cent to 1.6 per cent).

Eurozone unemployment at 10:00. Rate expected to fall from 12.2 per cent to 12.1 per cent.

US July employment change at 13:15. ADP measure expected to fall from 188,000 to 182,000.

US second quarter gross domestic product at 13:30. Annualised figure expected to fall from 1.8 per cent to 1.2 per cent. GDP price index expected to fall from 1.3 per cent to 1.0 per cent.

US second quarter personal consumption expenditures at 13:30. Prices expected to increase from 1.0 per cent to 1.6 per cent. Core figure expected to fall from 1.3 per cent to 1.1 per cent.

US July Chicago purchasing managers’ index at 14:45. Expected to increase from 51.6 to 54.0.

US Federal Reserve interest rate decision at 19:00. Expected to remain at 0.25 per cent. To be followed by a monetary policy statement and press conference.