More data points to UK economy avoiding recession but experts urge Hunt to prevent investment cliff edge at March budget

The prospect of the UK avoiding a recession after a batch of better than expected recent data has propelled business confidence higher, a closely watched survey out today shows.

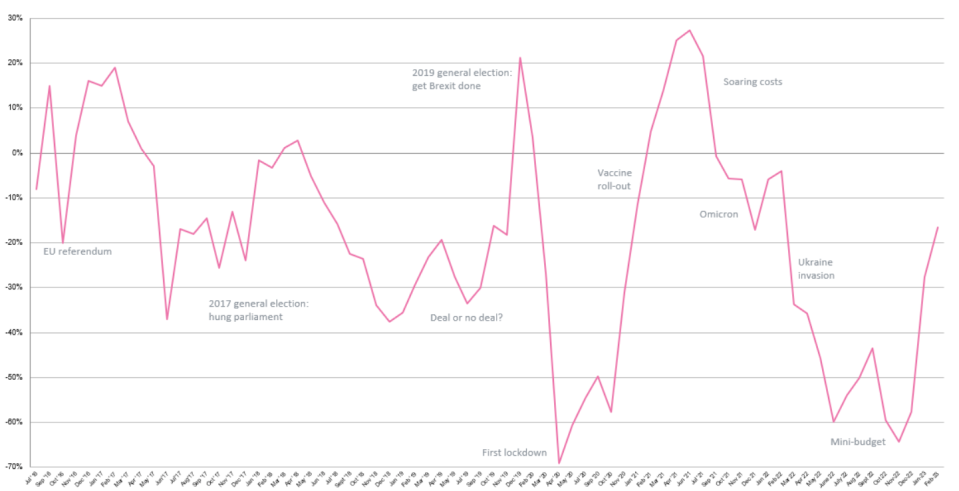

Optimism among company leaders jumped 11 points to minus 17 this month, shifting it back to levels seen when the government launched Plan B measures to deal with the omicron Covid-19 variant.

The numbers, compiled by the Institute of Directors (IoD), signal the underlying strength of the UK economy is a lot better than people feared at the turn of the year.

“Business sentiment is improving from its historic lows, driven primarily by a growing sense that prospects for inflation are improving and the economy is proving more resilient than previously feared,” Kitty Ussher, chief economist at the IoD, said.

Several closely watched surveys out this month have topped analysts’ expectations.

S&P Global’s purchasing managers’ indexes revealed the country’s private sector economy returned to growth this month, while numbers from the Office for National Statistics (ONS) showed inflation dropped for the third straight month to 10.1 per cent in January, a steeper fall than forecast.

Nearly one in four business leaders said trade friction with the EU after Brexit was the top reason for their economic pessimism, although the IoD carried out the survey before Prime Minister Rishi Sunak yesterday announced a new deal with Brussels to unpick difficulties arising from the Northern Ireland protocol.

Business confidence is back on the rise

Jeremy Hunt must soften the blow from a six point corporation tax hike to 25 per cent at the 15 March budget to stop businesses from scrapping desperately needed investment, the IoD urged.

“While sentiment remains subdued, government policy will need to work harder to encourage businesses to put capital at risk to undertake the investment the economy needs. That’s why we’re urging the government to prioritise investment incentives in the forthcoming budget,” Ussher added.

Research by the economic think tank the Institute for Fiscal Studies (IFS) out earlier this week found Hunt would struggle to hit his fiscal targets – debt as a share of GDP falling and borrowing capped at three per cent of GDP in five years – if he launched permanent tax cuts and spending rises at next month’s budget.

Anaemic growth over the long-term is poised to erode his fiscal headroom, the IFS said, which economists have argued could be reversed by a business investment boom.