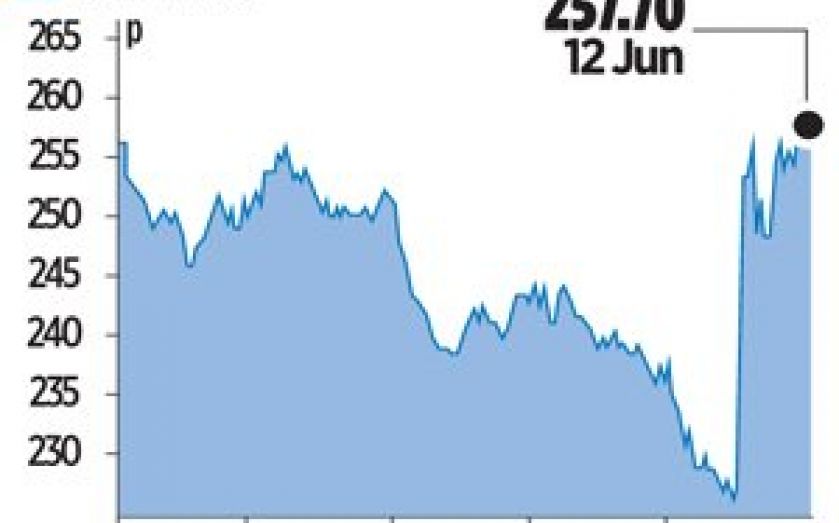

Lonmin share price rockets on hope of end to strike action

Shares in South African platinum miner Lonmin soared almost nine per cent yesterday, after the dominant union representing its workers presented its wage proposals to its members.

FTSE 250-listed Lonmin, alongside peers Impala Platinum and Anglo American Platinum, has been locked in months of negotiations with the militant Association of Mineworkers and Construction Union (Amcu), which has been demanding higher pay for its members.

A 21-week strike has crippled the country’s platinum industry, with Lonmin most affected, as all of its mining operations are currently offline.

Last month, Lonmin fired 235 essential services employees and warned that further job cuts and restructuring were inevitable, as it revealed a steep decline in half-year profit to $34m (£20.2m) from $93m.

“The principles that underpin the proposals seek to achieve a sustainable future for the three platinum companies for the benefit of all stakeholders and to afford employees the best possible increase under the current financial circumstances,” said Lonmin in a statement.

The three companies expect to receive feedback from Amcu today, in the hope of an agreement that will lead to employees returning to work.

The trio, which together produce over half of the world’s platinum, have so far lost more than 21.7bn rand (£1.2bn) in earnings.

“Amcu’s leaders have appeared to be the main blocker of previous offers, so the agreement to present an offer to its members suggests that a resolution is possible,” said BMO analysts in a note.

“[We estimate] that it will take a further 90 days for the first refined platinum ounces to be produced. This potentially takes total production losses for 2014 to 1.9m ounces of platinum before taking into account the speed or ease of the production ramp-up process.”

Shares in Lonmin closed up 8.87 per cent yesterday.