London suburb of Harrow emerges as unexpected hotspot for tax avoidance

The London suburb of Harrow has been revealed as the unexpected centre of tax avoidance in the UK with 346 taxpayers coming forward to admit tax avoidance last year, placing it first out of 120 areas of the UK.

In fact, The number of people admitting to tax avoidance in Harrow has jumped 280 per cent since last year, when only 91 taxpayers came forward, according to fresh data sent to City A.M.‘s newsroom today.

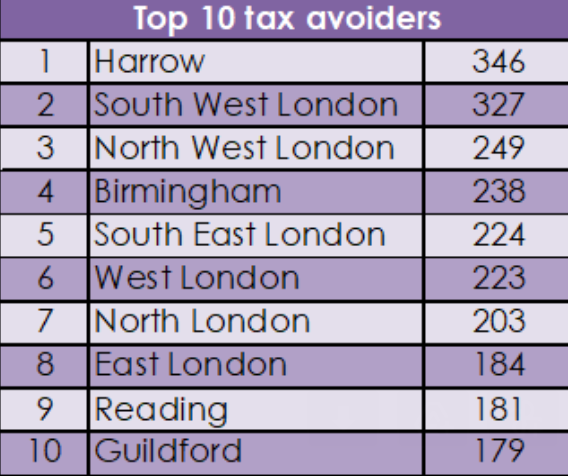

Harrow has now taken the crown from last year’s leader, the affluent area of South West London, home to the wealthy neighbourhoods of Chelsea, South Kensington and Wimbledon, research by accountancy group UHY Hacker Young found.

As a result of this bumper year, Harrow now has more disclosures of tax avoidance than the cities of Leicester (141), Nottingham (104), and Manchester (96) combined.

Well-off neighbourhoods in London, such as Knightsbridge, Chelsea and Putney, as well as the surrounding Home Counties of Surrey and Berkshire continue to make up nine of the Top Ten areas for reporting tax avoidance.

Birmingham was the only area outside the South East featured in the top 10, with 238 confessions of tax avoidance. In the same period, the average number for the UK was just 57.

Andrew Snowdon, partner and head of Tax at UHY Hacker Young, said that taxpayers today have become more likely to confess to tax avoidance to avoid the increasingly punitive penalty regime introduced by HMRC.

Since 2017, HMRC penalties can now be up to 200 per cent of the amount of tax not paid. With many of the areas in the Top 10 having some of the highest tax bills in the UK, taxpayers there may be more inclined to self-report unpaid tax.

“Harrow is not where people would expect to see such high levels of tax avoidance,” Snowdon said.

“Historically tax avoidance reports originate most often in the wealthiest boroughs of London and the stockbroker belt – places where wealthier individuals might have assets offshore. Harrow doesn’t really fit that profile,” he added.

“Some people may think it’s easy to avoid reporting tax, such as from by to let income. In actual fact, they are making their situation far more difficult by letting unpaid tax build up until it is finally discovered by HMRC,” Snowdon concluded.