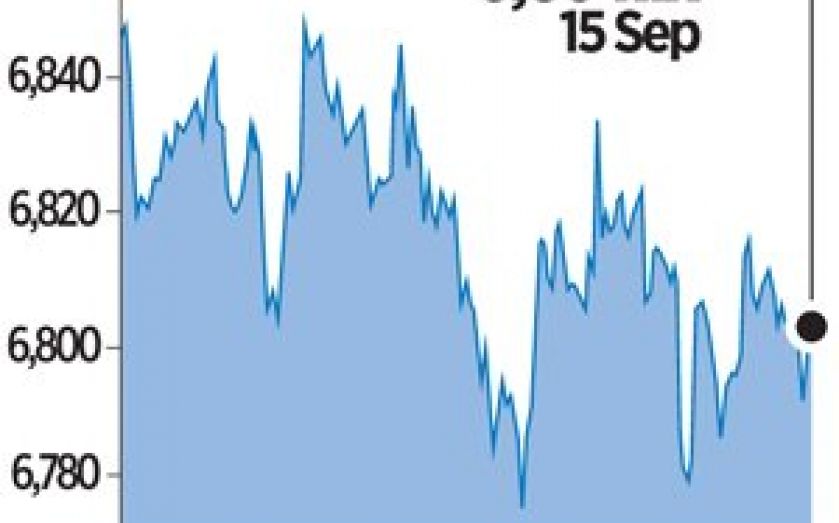

London Report: Energy firms drag down FTSE on China and Russia concerns

ENERGY shares capped the FTSE 100 yesterday, hit by the combination of slowing economic growth in China, the world’s top energy consumer, and new sanctions against Russia.

They offset a boost from mergers and acquisitions speculation in the beverages sector, which saw shares in SABMiller up 9.8 per cent on the back of a report about takeover interest from larger rival Anheuser-Busch InBev.

The blue chip index the closed 2.75 points, 0.04 per cent, or 6,804.21 points.

Beverages behemoth SABMiller jumped 9.82 per cent to 3,740p as Heineken rejected a takeover.

But BG slid 2.1 per cent, its seventh day of losses, to 1,153.5. Petrofac, the UK’s largest oil and gas engineer, slipped 0.7 per cent to 1,055p, for its lowest price in more than four years.

Dixons Carphone added 2.1 per cent to 379.90p, after high street rival Phones 4u, which has 5,596 employees and 550 standalone stores, filed for administrator’s protection.