Mansion tax talk and cooling London house prices fail to dent Savills expectations

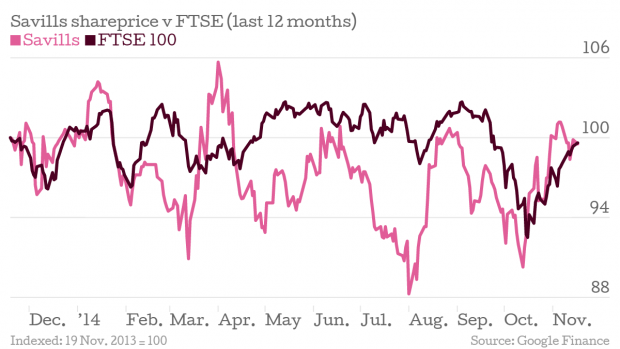

Upmarket estate agent Savills is weathering the moderation of the London property market and the fall in commercial trading volumes in Hong Kong, as other global hotspots continue to perform.

In an interim statement published today, the group said it has been affected by the threat of a mansion tax, which could be implemented after next year's general elecetion. It added the UK market was performing in line with expectations, with an increase in sales volume outside London making up for cooling in the capital's market.

Hong Kong, another driver of Savills’ revenue, has been coming off the boil, but performances in the UK and US mean the international real estate advisor expects to “at least” match its previous expectations.

Growth in the UK’s housing market has been slowing, with London at the centre of the moderations. The capital, by some measures, is no longer the region with the fastest-growing house prices, and Savills is working to mitigate the impact.

Our UK residential agency business has continued to trade well since June, with a resilient performance from the prime London markets, which have moderated in recent weeks in line with our expectations.

The general election and the potential implementation of a "mansion tax" thereafter has had the expected subduing effect on buyers, albeit that we have seen registered buyers per listed property rise since the low point around the Scottish independence vote in the summer.

The country market has seen the rise in activity that we had anticipated and demand is focused clearly in the sub £2m market. Residential development sales have continued to perform strongly.

The ONS will release its house price data later today, which is expected to confirm the market’s cooling. Numis, an institutional stockbroker and corporate advisor, said this morning it expects Savills to post profit before tax of £90.1m for the 12 months to 31 December 2014, an increase of 20 per cent.