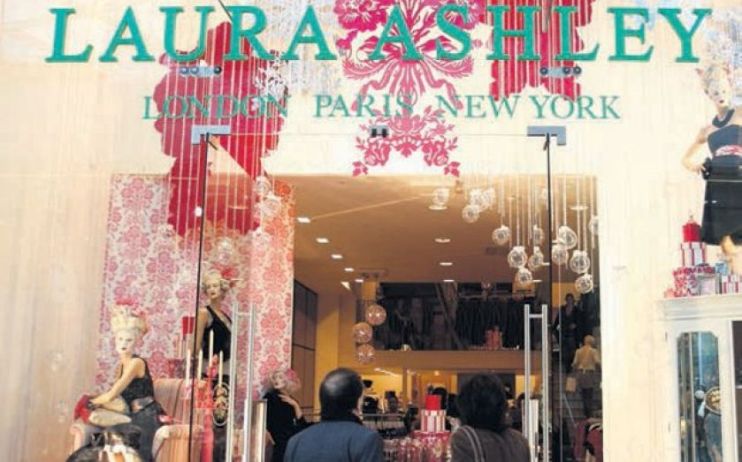

Laura Ashley shares bounce back after lender offers lifeline

Shares in Laura Ashley jumped more than 45 per cent today after the struggling retailer secured access to a £20m lifeline following emergency talks with its lender.

The high street brand said today that discussions between Malaysian owner MUI Asia and Wells Fargo over access to a working capital facility had concluded.

In a statement this afternoon the retailer said: “The group should be able to utilise requisite funds from its working capital facility to meet its immediate funding requirements.”

The agreement does not include a cash injection from MUI Asia, the company added.

The future of the company had been thrown into doubt over access to the asset-backed loan, agreed with Wells Fargo in October, which was tied to Laura Ashley’s stock and customer deposit levels.

After those assets fell, the amount of the £20m facility the retailer could access also dropped, putting its ability to continue to trade at risk.

Laura Ashley – which is due to publish its interim results tomorrow – revealed earlier this week that total group sales fell 10.8 per cent from £122.9m to £109.6m in the 26 weeks to the end of December.

The fashion and homewares brand blamed the revenue drop on “market headwinds and weaker consumer spending during the period, which led to a decline in sales of bigger ticket items”.

However, it said trading was flat in the first seven weeks of the year as it began to implement a turnaround plan.

Founded in 1958, Laura Ashley enjoyed a heyday in the 1980s, but has been a victim of the gloom shrouding the UK’s retail sector in recent years.

The company reported a full-year loss of almost £10m in the 2018-2019 financial year.