Informa receives second full takeover approach

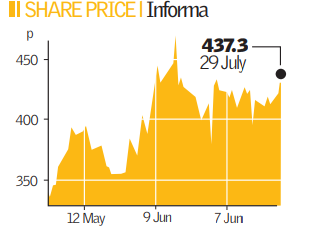

Informa shares spiked after the publisher and events organiser revealed it had received an approach from another potential suitor.

Informa said it is still in discussions with a Providence Equityled consortium, but it has also now provided information to the new bidder.

It stressed the approach was preliminary only.

Buyout firms Providence Equity, The Carlyle Group and Hellman & Friedman made an approach earlier this month, after United Business Media walked away from nil-premium merger talks with Informa because the two could not agree on numbers. The market place was rife with rumours over the identity of the new bidder. Reports suggested that a Blackstone-led consortium involving KKR and Permira and sovereign wealth fund Dubai World Trade Centre, were the new bidders.

UBM chief executive David Levin has played down the idea that merger talks with Informa could be revived.

“We’re not involved in any discussions there,” Levin said, “The moment passed and we’re focusing on other things,” he said on Monday.

Meanwhile, the Providence-led consortium is rumoured to be finding it difficult to raise enough cash to fund a takeover bid, which includes taking on £1.2bn worth of Informa’s debt.

Media reports suggested Hellman & Friedman had pulled out of the consortium, but the company was not immediately available to comment.

There has also been speculation that Springer, the German publishing group owned by private equity firms Candover and Cinven would be likely bidders.

Informa shares jumped as much as 7 per cent, before falling again to finish 3 per cent higher at 437.25p, valuing the company at £1.8bn. It posted increased first half profits and revenues on Monday.