IEA warns OPEC+ cuts risk pushing global markets into recession

OPEC+’s decision to heavily cut oil production risks driving up prices and pushing the global economy into a recession, warned the International Energy Agency (IEA).

The Paris-based climate watchdog feared that OPEC+’s reductions in oil output will sharply derail the growth trajectory of supplies into next year, driving up prices and worsening concerns over market volatility and energy security.

It said: “With unrelenting inflationary pressures and interest rate hikes taking their toll, higher oil prices may prove the tipping point for a global economy already on the brink of recession.”

Last week, OPEC+ announced it would to cut oil output by 2m barrels per day from next month, to try and arrest a slide in prices across both major benchmarks.

This is its biggest reduction is supplies since the pandemic.

OPEC+ consists of the central organisation OPEC, and a range of allies including Russia.

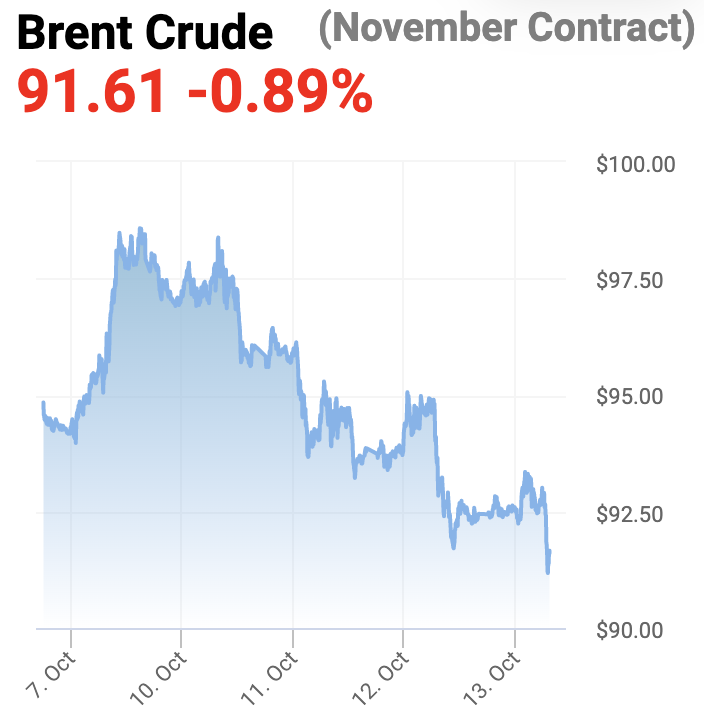

It made its decision to act after witnessing prices fall from from 14-year highs in March of $139 per barrel and months of trading above the $100 milestone, following Russia’s invasion of Ukraine and subsequent Western sanctions below the $90 threshold.

Prices rose over supply concerns and post-pandemic consumption demand, but this has eased with Europe securing supplies ahead of schedule while Covid-19 lockdowns in China and recession fears has curtailed demand.

This afternoon, Brent Crude and WTI Crude are trading at $91.40 per barrel and $86 per barrel respectively.

These prices are significantly above the pandemic troughs, when it was trading below $30, but well below the rallying prices recorded in the spring.

IEA: Oil supplies set for sharp decline

The IEA outlined it concerns for the market in its monthly oil report, where it forecast that slower economic growth would cause demand for oil supplies to ease into next year.

It now expects oil demand to contract by 340,000 barrels per day in the foruth quarter of this year, with demand growth for next year to fall from 2.2m barrels per day to 1.7m barrels per day.

However, it is unclear whether this will offset its expectations of reduced supplies following OPEC+’s heavy cuts.

World oil supply rose by 300,000 barrels per day in September to 101.2m barrels per day, with OPEC+ providing over 85 per cent of the gains.

Nevertheless, after a 2.1m barrel per day boost from the second and third quarters of this year, growth is now expected to decelerate in the last three months of the year to just 170,000 barrels per day.

The decline in OPEC+ supply will be smaller than the announced 2m barrel reduction in production targets, as the majority of the alliance’s members already producing well below their ceilings due to capacity constraints.

The cartel has persistently missed pledged increases in production this year amid capacity issues and concerns over antagonising OPEC+ partner Russia, as it remains neutral over the conflict in Ukraine.

Despite this, the IEA still estimates is a decrease of around 1m in crude oil output from November, with the bulk of the cuts delivered by Saudi Arabia and the UAE.

There are also expectations of further losses from Russia in December, with the EU embargo on Kremlin-backed crude oil shipments expected to go into full effect.

Russian officials have threatened to cut oil production further in order to offset the negative impact of proposed price caps, backed by the G7 and the European Commission.

With less than two months to go before a ban on Russian crude oil imports comes into effect, the IEA warned that European Union member states will have yet to diversify more than half of their pre-war import levels away from Russia.

Nathan Piper, head of oil and gas research, told City A.M. that the effects of EU sanctions on Russian production is “the unknowable” factor that could determine supplies this winter.

He said: “Material reductions in Russian seaborne oil volumes could tighten the market even further, OPEC+ cutting ahead of that is heightening concerns. However the Energy Information Administration has also reduced US production growth assumptions with reduced oil and gas investment in developed markets also contributing to a tight global oil market.”

OPEC under pressure from West

The IEA’s forecast follows OPEC announcing its own predictions yesterday, where it also cut its expectations for growth in world oil demand.

While its central outlook is comparable to the IEA’s, its expectations for demand are higher – at 2.6m barrels per day next year compared 1.7m barrels per day in the fourth quarter of 2022.

This is the fourth time it has downgraded growth expectations since April, with the group ditching IEA data over concerns around its ties to the West.

OPEC cited slowing economies, the resurgence of China’s COVID-19 containment measures and high inflation as key headwinds in the oil market.

US President Joe Biden has warned that the country will have to reconsider its relationship with Saudi Arabia following the latest cuts.

The Democrat leader is eager to contain gas prices and ease the cost of living ahead of key mid-terms in November, with the Republicans on course to challenge his majority in the House of Representatives and the Senate.

Saudi Arabia has rejected the possibility of US retaliation, and insists the decision was purely about balancing markets, rather than politics.