Hunt on course to miss fiscal targets despite £55bn of tightening, Deutsche Bank bet

Chancellor Jeremy Hunt is on course to miss his fiscal goals due to a weaker growth outlook than forecast by the UK’s budget watchdog, an investment bank has said.

According to Sanjay Raja, senior economist at Deutsche Bank, the Office for Budget Responsibility’s (OBR) GDP growth forecasts are too optimistic.

Last week, the OBR said the economy is in a recession right now and will shrink 1.4 per cent next year.

However, growth will rebound sharply after 2024, with the economy expanding over two per cent each year until 2027.

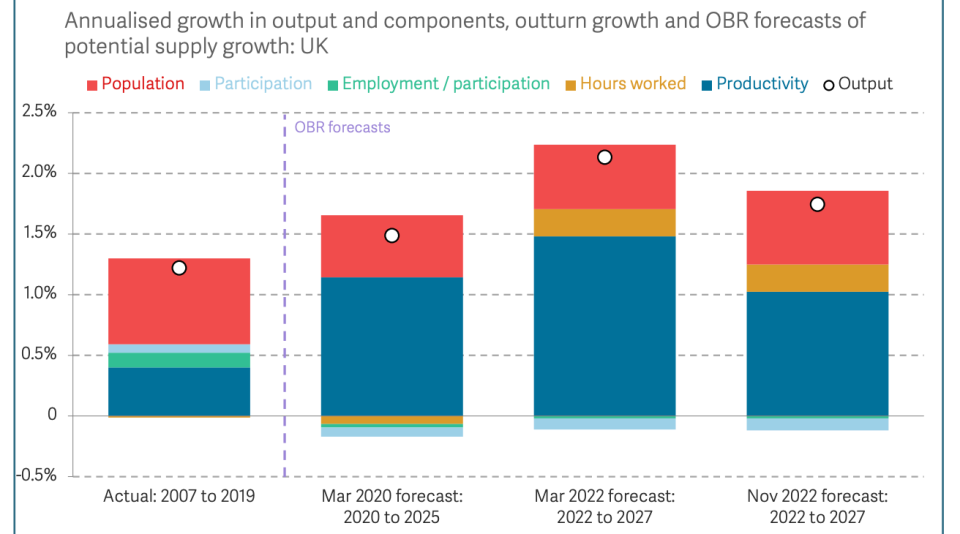

The swing from contraction to expansion is based on rosy assumptions about productivity growth, which since the financial crisis, has been underwhelming in Britain.

Raja said: “Under our own growth forecasts (and weaker potential growth assumptions), the chancellor will likely miss his target of getting debt to GDP down in 2027/28.”

“All of the Chancellor’s headroom will likely be wiped away, with debt- to-GDP rising by 0.3pp in 2027/28 instead,” he added.

OBR thinks productivity growth will power economy in coming years

Hunt last Thursday tweaked the UK’s fiscal rules to getting debt as a share of the economy falling and capping borrowing to fund day-to-day spending at three per cent in five years.

The move created some extra room to borrow in the short term to offset the damage of the coming recession, expected to last between one and a half and two years.

Deutsche Bank’s lower growth forecasts mean the government would collect less tax revenue than the OBR expects, thereby forcing them to borrow from international investors to maintain current public spending levels, likely breaking Hunt’s new rules in the process.

Hunt last Thursday hiked taxes and cut public spending by around £55bn to ensure he met his new fiscal targets. If he did not change the rules, set by now prime minister Rishi Sunak when he was chancellor, the OBR judged he would have broken them.

UK governments began setting fiscal rules in the 1990s. They are essentially arbitrary targets, often determined by values held by the incumbent political party.

They are intended to convince investors of Britain’s financial credibility by reducing borrowing and debt over the long term.

Former prime minister Liz Truss spooked investors by launching £45bn of unfunded tax cuts on 23 September without asking the OBR to produce an assessment on the public finances.

The organisation would have almost certainly judged she had blown the fiscal targets by a considerable margin.

The treasury has been contacted for comment.