How wave power can help you to read the markets

The markets are anything but random, say proponents of Elliott Waves. Understanding them will improve your trading.

Most people are led to believe that the markets are completely random and that there is no way of forecasting the next move, either up or down. But others seem to make large amounts of profits catching the waves in the financial markets. How do they do it?

One useful technique to predict the markets is to use Elliot Waves. These were the brainchild of Ralph. N. Elliott, who in the 1930s discovered that the stock market had distinctive patterns. These patterns provided a glimpse into the future.

Although he was gravely ill at the time of his research, Elliot spent over eight years studying price data and – at the age of 75 – on 10 June 1946 published a book called Nature’s Laws – The Secret of the Universe, which quickly and understandably sold out.

Today, R.N. Elliott’s legacy is alive and well and the Elliott Wave Principle is the study of commonly occurring patterns in financial markets is used by traders all around the world.

Five up, Three down

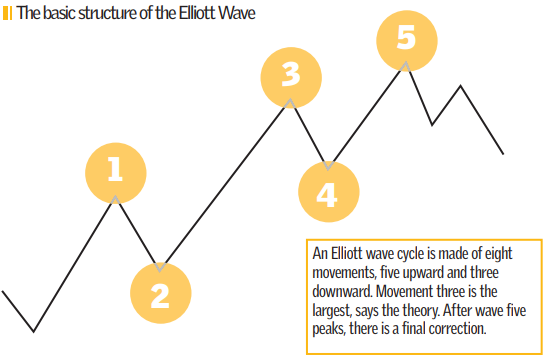

The theory is that markets move in a predictable series of waves. As Robert Prechter wrote in his book Elliott Wave Principle: “Elliott pointed out that the stock market unfolded according to a basic rhythm or pattern of five waves up and three waves down to form a complete cycle of eight waves. The three waves down are referred to a as a correction of the preceding five waves up”. (See chart 1.)

The basic premise is that once an initial move up has started, wave two then takes the price down again before wave three pushes it up again. Thereafter a correction via wave four will lead to the final wave five before another correction occurs.

Although this sounds complex, once a trader learns the basics of Elliott’s waves, to the trained eye these patterns can jump out from a chart.

What is also interesting is that the methodology can be found to work across stocks, commodities and the foreign exchange markets. It can also be seen to work across different time frames from intra-day to daily, weekly, monthly and yearly charts.

Elliott Waves have become big business. Anyone or any method that can predict market moves is surely going to catch the attention of profit seekers. The million dollar question is: does this work?

The short answer is that at least sometimes, yes it does.

Take the example of March 1935, when the Dow Jones Rail Average had fallen below the 1934 low and the Dow Jones Industrial Average had also lost 11 per cent.

Whilst most analysts and traders during that time were screaming and panicking that there were more falls to come, Elliott insisted that the bear market move was over and that another leg of the bull market was just about to begin.

He was spot on with his analysis and within the hour of his forecast the bull market move had begun.

Clear Example

Of course, as with any trading method there are faults or discrepancies and the Elliott Wave theory does have its problems. There are times when wave five is the strongest move, and not wave three as the theory predicts, and there are other times when there are no clear wave counts.

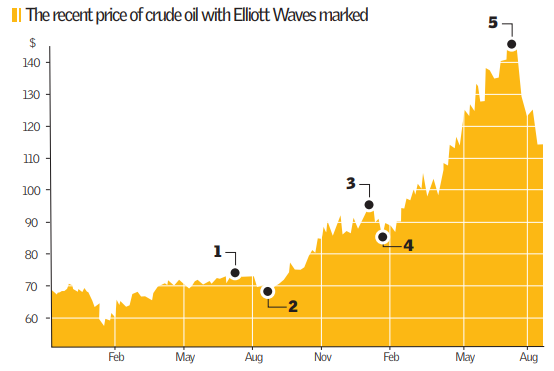

Take as a good example the current crude oil price, which has been extremely volatile in recent weeks and months. (See chart 2.)

We can clearly see that there was a move up after wave two, but it is wave five which has been the strongest and has now been followed by a sharp correction. Although this is by no means a perfect Elliott Wave , what is striking is that we can identify and acknowledge that markets do indeed move in waves.

There are numerous examples in various markets to prove this point and as students of the markets we can only observe this in awe.

Common Pattern

Pattern recognition can be a very useful tool and one which can provide us with a glimpse into the future move of a stock or commodity. When you find the beginning of a common pattern, it can be possible to calculate the most probable targets both in price and time.

These can be used to identify support and resistance points and to help identify low risk trades as well as profit targets.

When combined with other methods such as Fibonacci Analysis, Elliott waves can therefore be a very powerful method to employ in trading the financial markets.

Although there may not be an Elliott Wave forming on your chosen stock at this moment, learning the principle can provide potentially large rewards.

While in his day R.N. Elliott had to make do with pen and paper to form his market analysis, today’s traders have at their fingertips technology and comprehensive charting packages to help them identify the waves that can make them rich, and trade on them at the speed of light.