High street retailers urged to offer opt-out option for ‘buy now, pay later’ plans

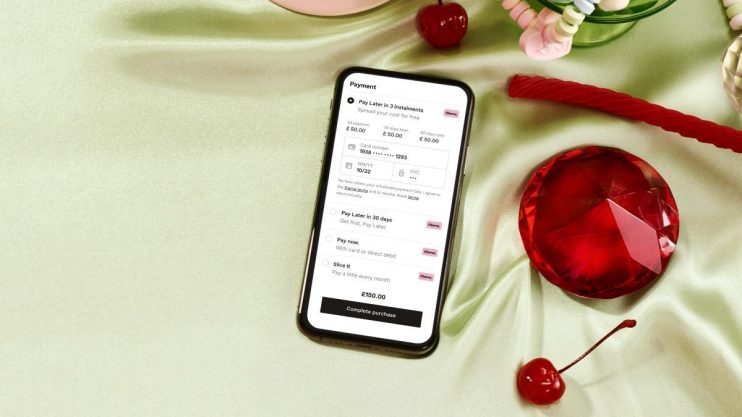

High street retailers have been urged to allow shoppers to opt-out of being shown “buy now, pay later” options, over concerns that the easily accessible credit could push vulnerable people into unaffordable debt.

The Money and Mental Health Policy Institute, an initiative set up by personal finance guru Martin Lewis, said retailers should “help people avoid taking out credit they can’t afford to repay” by removing the option for some customers.

Read more: City watchdog launches crack down on ‘buy now, pay later’ deals

Research by the Institute showed that people with mental health problems are more likely to end up in financial difficulty after taking out credit.

Meanwhile, the popularity of “buy now, pay later” options among retailers has soared, with well-known fashion brands H&M, Asos and Topshop among the companies offering customers credit.

A quarter of people with mental health issues said they spent more than they can afford because they could get credit at the point of sale, compared to 17 per cent of consumers without mental health issues.

The same number of shoppers suffering with poor mental health said they had impulse-bought products they did not really need because there was the option to pay later.

The Institute also called for late or missed-payment charges to be made clearer at the point of sale.

Read more: Klarna becomes Europe’s most valuable fintech in £460m raise

Money and Mental Health Policy Institute chief executive Helen Undy said: “We’d like to see online retailers offering people the chance to opt-out of these payment options altogether, to help people avoid taking out credit they can’t afford to repay.

“Retailers should also make sure that information about charges for missed repayments is made absolutely clear up front, so that consumers can better understand the implications of taking out this kind of credit.”

Main image credit: Getty