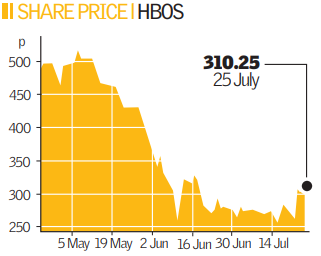

HBOS set to report big fall in profits

Troubled mortgage giant HBOS will announce interim results this week, with profits expected to have fallen more than 50 per cent year-on-year, as investors call for asset sales to offset heavy write-downs.

Analysts are forecasting a slump in profits to £1.3bn, due in part to losses related to the US sub-prime mortgage crisis and stuttering housing markets when it reports on Wednesday.

Institutional investors are now calling on CEO Andy Hornby to sell assets to shore up the bank’s ailing balance sheet.

One asset sure to be sold is vehicle hire company Hill Hire, which will will cost suitors around £300m.

An analyst close to HBOS said: “This has been on the cards for quite a while now. All big banks sell assets from time to time.”

Other mooted sales include fund manager Insight and HBOS’ Australian unit, Perth West, thought to be a target for the National Australia Bank (NAB) and the Commonwealth Bank.

HBOS could struggle to raise funds by any other means, after its disastrous £4bn rights issue left underwriters Morgan Stanley and Dresdner Kleinwort needing to place a gigantic rump of shares in the market.

Although HBOS got its money, the demand for bank shares remains low, leaving asset sales as the easiest way of raising capital.

One analyst said: “No-one should be surprised by a decline in banking profitability. All of the UK banks will report declining profits this week; they can’t defy gravity.”