Gas prices could fall to zero predict experts as conditions ease over summer

Gas prices will continue to slide this summer with day-to-day prices potentially dropping close to zero, argued energy experts, despite the latest uptick across both major benchmarks this week.

The UK Natural Gas Futures benchmark is up nearly 14 per cent in this afternoon’s trading, at around 65p per therm – a sharp uptick on the 58p per therm price it closed at yesterday.

Across the channel, the Dutch TTF Futures benchmark is up 11 per cent over the same period, at just under €28 per megawatt hour.

Ole Hansen, head of commodity strategy at Saxo Bank told City A.M. that gas prices are not the sign of a new rally across commodity markets.

He said: “Overall, the European gas market remains well supplied and gas storage sites continue to fill at a rapid pace. Not least considering weak industrial demand, some of which is now expected will not return, either due to savings or energy intensive production having been reduced or moved out of the Europe.

“Should gas storage sites fill up before winter demand kicks in we may face short periods, especially on days where production from sun and wind are strong, where the day-to-day gas price drop close to zero, or perhaps even below.”

In his view, countries with limited storage such as the UK have a higher chance of briefly seeing short-term natural gas prices dip below zero.

He argued that the latest bounce in gas prices follows reports of leaks at Equinor’s LNG plant in Hammerfest, Norway, has caused spot prices to climb but had a more muted effect on futures markets.

The plant recently reopened after a shutdown last month.

It is Europe’s biggest LNG plant, and when fully operational accounted for five per cent of Norway’s gas exports.

However Equinor revealed production continued despite the evacuation of personnel from the area where the leak was detected.

Gas prices dip from record energy crisis peak

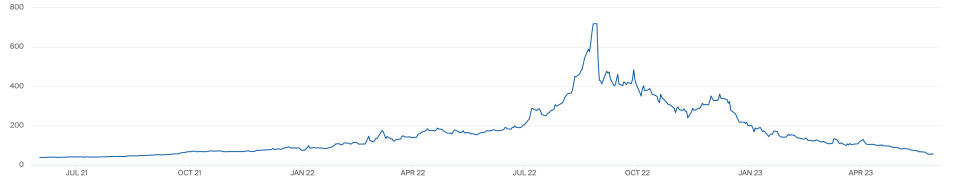

The drop in gas prices reflects a remarkable shift in energy market, with prices rising above €350 per MWh to record highs last August, with investors fearing blackouts amid a Russian squeeze on supplies into Europe.

Since then, a combination of the European Union successfully stocking up supplies, warmer-than-expected winter weather, and economic uncertainty has eased demand and lowered fears of shortages.

As it stands, total inventory levels across Europe are currently near 67 per cent full.

Hansen noted a steep contango had developed in the market – with futures prices significantly higher than spot prices – with the current spot market around €25 per MWh while winter contracts were still elevated at around €43 per MWh.

This presented an opportunity for companies which own storage facilities to buy gas now and sell lucratively during the winter – with their strong demand for spot deliveries helping to speed up the refilling process.

He said: “Next winter, weather remains a key unknown, and the reason that prices remain relatively elevated is because daily flows will be needed to meet strong winter demand. The re-emergence of the La Nina weather pattern may further add to the uncertainty as previous periods triggered periods of colder than normal weather across Europe.”

Marina Tsygankova, research manager at LSEG Gas Research, also believed the latest upside in prices was due to the outage at Norway’ Hammerfest LNG plant.

She said: “Overall, the landscape in the European gas market remains bearish with healthy storage stocks and strong demand destruction remaining in place. Despite the heavy maintenance taking place at the Norwegian Continental Shelf, we still see a risk for storage to be completely full before the end of the summer season. This should continue to provide a bearish pressure on prices this summer, particularly on the near curve.”

As for potential headwinds that could challenge the latest price movements, she noted that the European gas balance currently depending heavily on LNG supply, meaning the ramp up in Asian demand is “a potential risk” as alongside “rebounding industrial demand on the back of falling gas prices.”

Craig Erlam, senior markets analyst for OANDA, argued that from whatever perspective, the situation was considerably more positive than last year’s crisis.

He said: “Efforts to maximise gas storage in Europe have undoubtedly paid off, thanks in part to favourable weather conditions. Storage levels are now much higher than the same period a year ago which bodes well going into next winter.

“As those levels rise over the summer, risks will continue to decline which could enable further declines in gas prices. Of course, in this environment, there are no guarantees and if the situation changes, spikes may occur but as of now, the situation looks vastly improved on last year.”