The FTSE in 2017: Five charts that tell the story

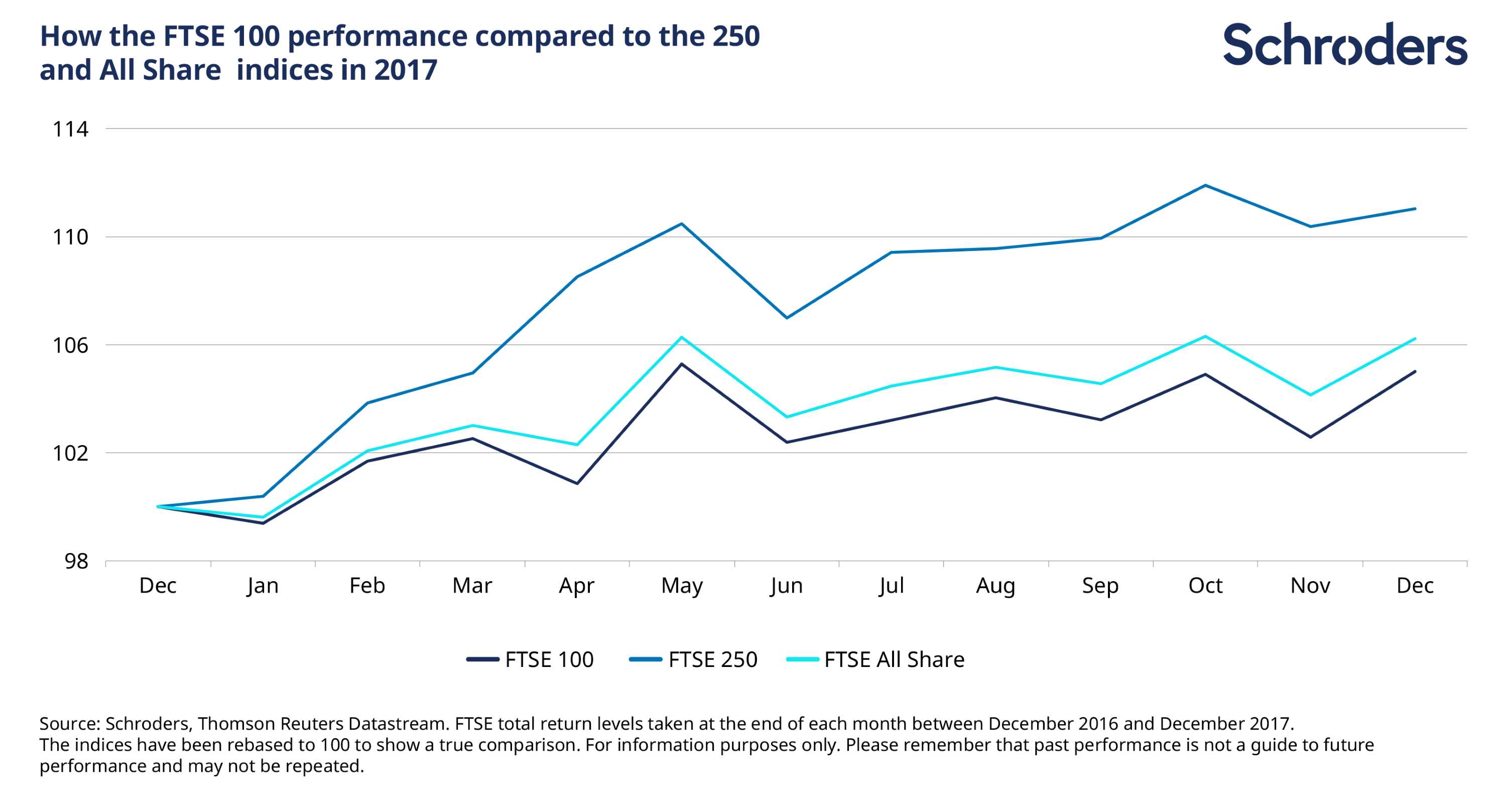

The FTSE 100, 250 and All-Share indices made strong gains in 2017. A record year for dividend payments and ongoing loose monetary policy from the Bank of England helped each index hit a record high in 2017.

By the close on 13 December 2017 the FTSE 100 was up 5%. But it was outperformed by the 250 and All-Share indices, which were up 11% and 6.2%, respectively. All indices were off their record highs by year-end, but not by much.

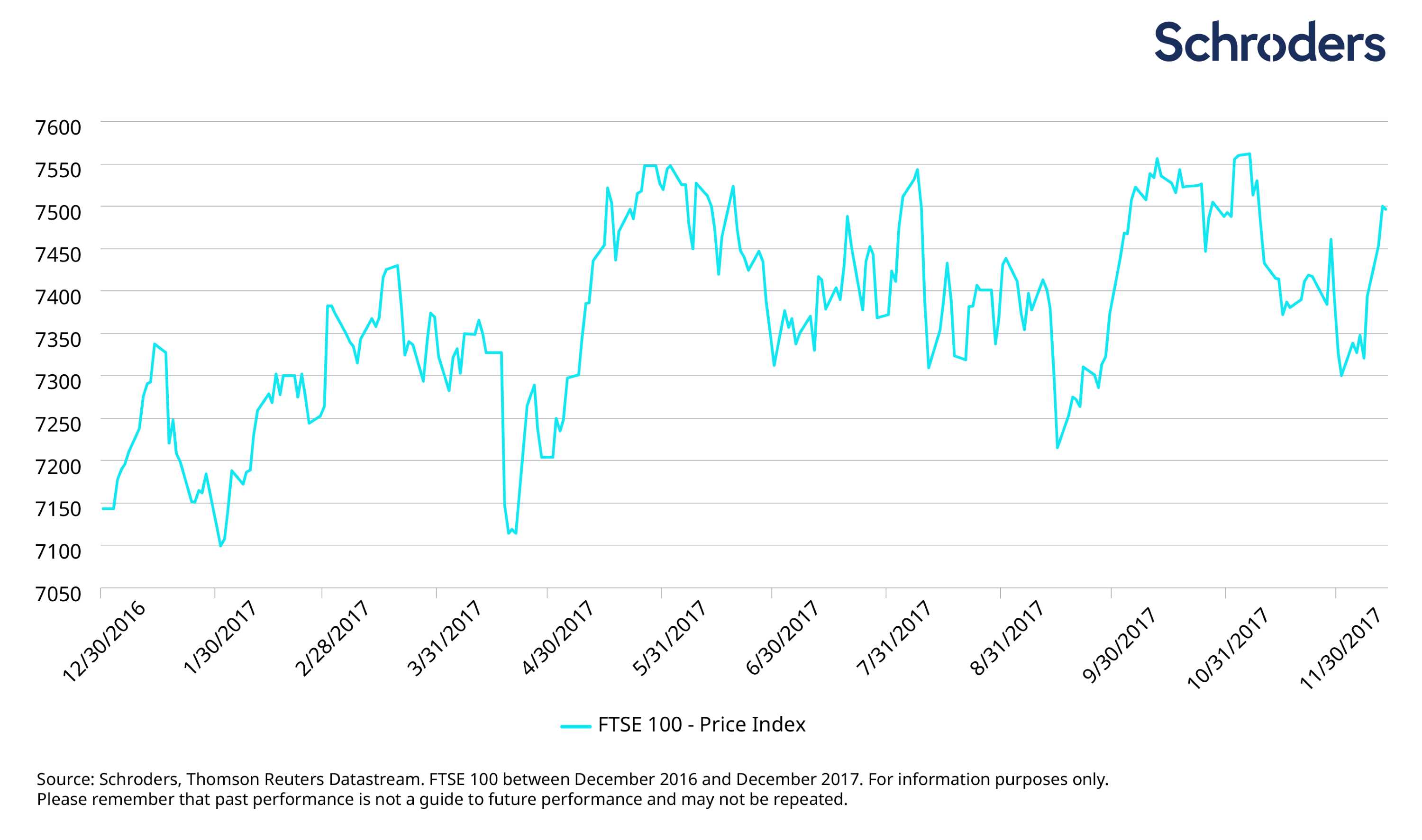

The UK stockmarket wavered during the summer following June’s snap general election. But more broadly it has been supported by the Bank of England’s monetary policy, which has included keeping interest rates low.

Dividends have been a factor too. Dividend payments by UK companies are set to reach £94 billion in 2017. The FTSE All-Share yields 3.65%. Compared with interest rates of 0.5% and UK government bond yields of around 1.3% (10-year gilts), the stockmarket remains attractive for investors searching for income.

The international nature of the London market means global factors have also played their part. Pro-business, pro-growth policies in China and the US, such as infrastructure projects and tax cuts, have helped bolster gains.

The performance of sterling has been a factor too, particularly for the FTSE 100. The indices have fluctuated in tandem with the currency.

How the FTSE performed in 2017

The FTSE risers and fallers

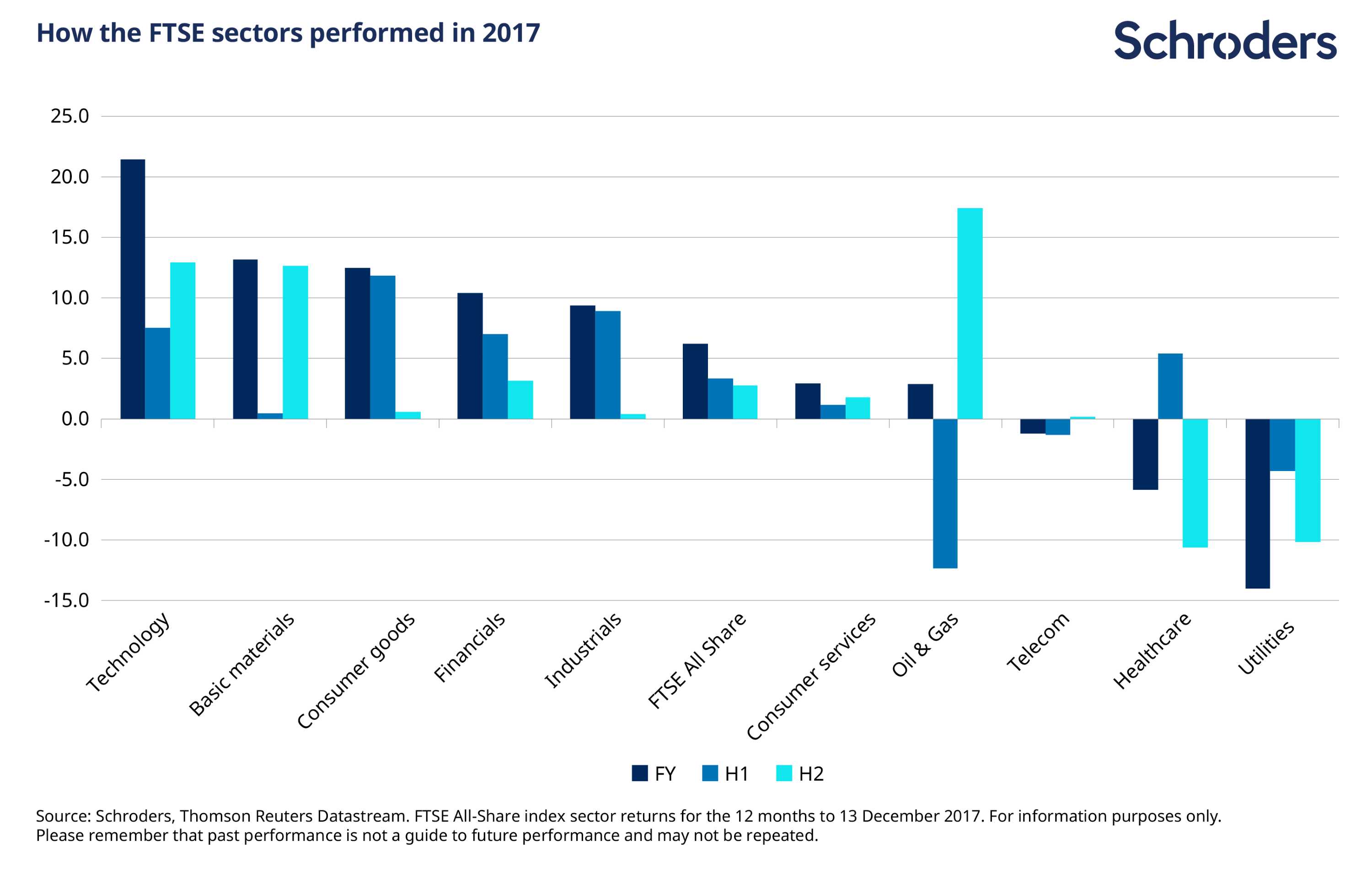

So-called “growth” shares, such as tech stocks, have been winners. Growth companies normally have earnings that are expected to grow at an above-average rate relative to the market.

The basic materials sector, which includes suppliers of the raw materials used in infrastructure projects, was one of the best performing sectors in 2017, up 13.2%. It was bettered only by the technology sector, which rose 21.5%.

The losers have mainly been domestically facing businesses such as utilities and some support services. Traditional income-paying stocks, such as healthcare companies, have struggled too.

Healthcare and utilities, which includes water and power suppliers, were the worst performing sectors, down 14% and 5.8% respectively.

Fund manager view – Matt Hudson, UK Equities:

“The premium achieved by the winners over the losers has been staggering.

“This has left the UK market with a large pool of generally lowly valued, higher yielding and, very importantly, underperforming stocks – pub companies, selective support services, domestic utilities, retailers and anything that does not fit into the market’s current narrative of what ‘good’ looks like.

“In part, the market has lost perspective on slow-moving incumbent businesses as it focuses on technological change.

“To misquote Bill Gates, investors always overestimate the speed of technology change but underestimate the impact over time.

“This certainly seems apt for the current market. Those stocks and sectors out of favour with the current focus on growth are often traditional income stocks, unlike during the technology, media and telecoms (TMT) period. During the TMT period value and income assets were derated but their profits were rock solid, now investors need to consider the sustainability of profits and dividends.”

The sterling effect

Sterling has endured another tumultuous year. The uncertainty over a deal for Brexit has kept its value near multi-year lows against most major currencies and in particular the US dollar.

The rise and fall of sterling has had a pronounced affect on the UK stockmarket, particularly the FTSE 100. The majority (71%) of FTSE 100 companies generate their revenues from outside the UK.

If sterling is weak then profits made abroad and dividends paid in a foreign currency are worth more once they are converted back into sterling if the currency is weak.

The chart below illustrates how the FTSE 100 has fluctuated in tandem with sterling. When sterling has been weak the index has risen and when it has strengthened the FTSE 100 has fallen. To some degree, this explains why the FTSE 100 has lagged the FTSE All-Share.

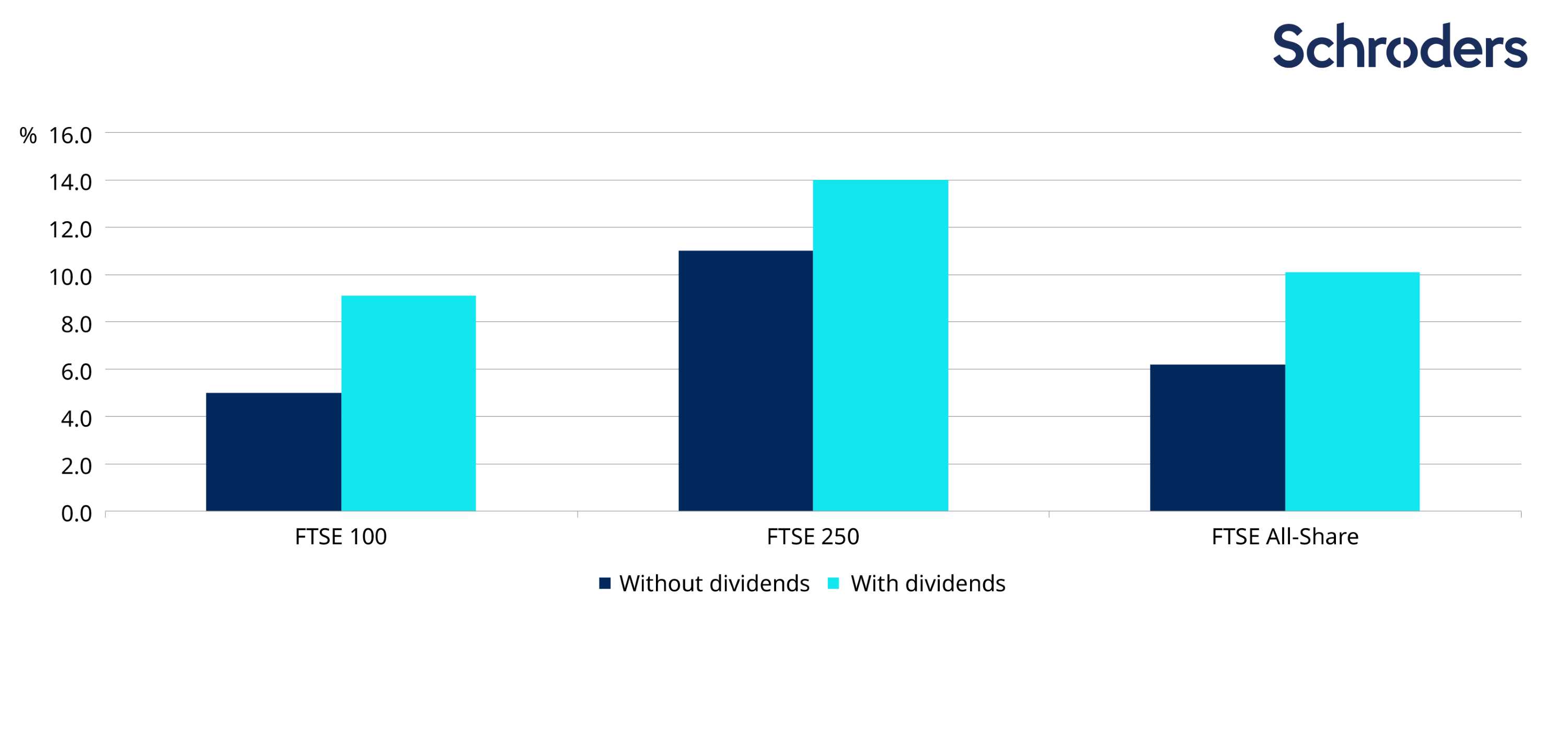

The power of the dividend

Dividends have provided a boost too. As the chart below shows the inclusion of dividends has nearly doubled the return of the FTSE 100 in 2017.

On a total return basis, which includes dividends, the FTSE 100 rose 9.1% and the FTSE 250 and the FTSE All-Share were up 14.0% and 10.1% respectively.

Fund manager view – Matt Hudson, UK Equities:

“The strategies that have been effective over the last five years – quality growth with a small/mid cap bias, are less likely to perform in the next few years.

“What will matter most is a flexible and pragmatic approach to achieving a premium yield.

“The challenge is finding companies that can sustain a high premium yield to the market and to deal with the idiosyncratic nature of the UK dividend base.

“A detailed knowledge of the UK dividend landscape and a top down recognition of the business cycle will be key to success.”

The full series of Outlook 2018 articles can be found here.

Important Information: The views and opinions contained herein are those of David Brett, Investment Writer, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. Issued by Schroder Investment Management Limited, 31 Gresham Street, London EC2V 7QA. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.